Unpacking the impact of tariffs: Stay diversified, stay invested

What you need to know:

- On April 2, President Donald Trump announced U.S. tariff plans, which included a 10% tariff on all countries, effective on April 5, as well as higher levies on imports on countries the U.S. has larger trade deficits with. The tariff announcement was more aggressive than expected, driving volatility in markets. On April 9, the U.S. announced a pause on the new tariff rates for 90 days. Now the tariff rate for all countries will move lower to 10%, except for China, whose tariff rate was increased to over 100%.

- Tariffs clearly pose a headwind to economic growth, as corporate profit margins are squeezed by higher prices and households see a decline in inflation-adjusted income. In addition, tariffs will likely put upward pressure on prices, as U.S. importers pass on some of the cost to consumers.

- While recession risks have risen, the U.S. economy is entering this period from a position of strength after two years of above-trend growth.

- We expect the Fed to continue easing policy in 2025, perhaps in the back half of the year, which would support the economy. Given the proposed tariffs could weigh on economic growth, the Fed may cut rates potentially more than the two times outlined in its March meeting this year.

- Stocks sold off sharply following the April 2 tariff announcement. However, the S&P 500 rallied on April 9 following the 90-day delay, gaining around 9.5%. This underscores the importance of maintaining a long-term focus during periods of volatility. Avoid making emotionally charged investment decisions, and remember that time in the market has proven to be a better strategy over time than trying to time yourself in and out of the market.

What is a tariff? A tariff is a tax on goods imported from another country, and, all else equal, it increases the cost of imports, making foreign goods less competitive in the marketplace.

On April 2, President Donald Trump announced higher-than-expected tariff rates on many of the U.S.'s largest trading partners. Countries such as those in the European Union, as well as Japan and Vietnam, were to be subject to levies of 20% or more, while imports from China were subject to a tariff rate of 54%.

On April 9, President Trump announced a 90-day pause on the new tariffs for all countries except China. Instead, all countries will be subject to a tariff rate of 10%, while China will be subject to a much higher rate of over 100%. A 25% tariff rate will remain on autos, steel and aluminum, while imports from Mexico and Canada that are compliant with USMCA (except for autos, steel and aluminum) will be exempt from tariffs. Markets welcomed the news, with the S&P 500 surging 9.5% on April 9, the third-best daily gain since 1950.

In this report, we offer a framework to assess how the announced tariffs could impact economic growth, inflation, central-bank policy, and financial markets. We also provide key financial insights for individuals and business owners.

Impact on the economy: A slowdown after above-trend growth

From an economic standpoint, the announced tariffs pose a downside risk to growth despite the U.S. being less trade-reliant compared with many of its largest trading partners. Corporate profits could be pressured from higher input costs, while households could see pressure from lower inflation-adjusted income. Consumer-spending data has gotten off to a sluggish start to begin 2025, as policy uncertainty has weighed on sentiment. While the 90-day pause on most countries could pave the way for future negotiations, policy uncertainty is likely to weigh on consumer and corporate sentiment in the near term.

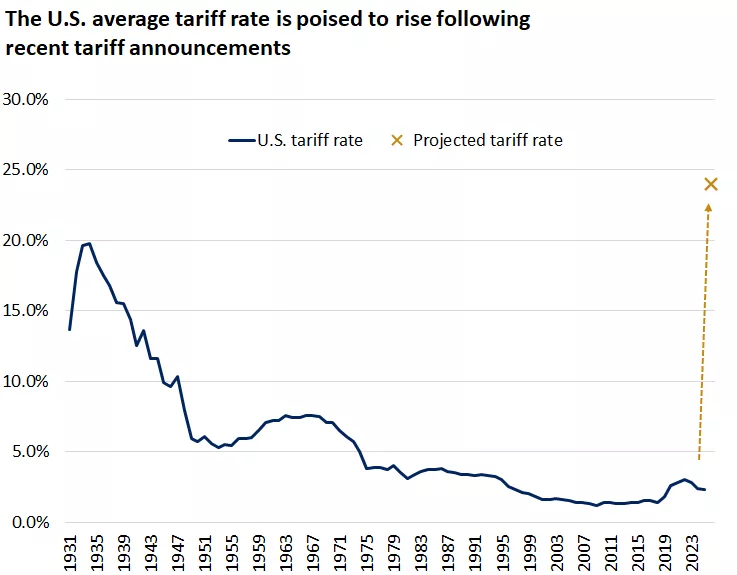

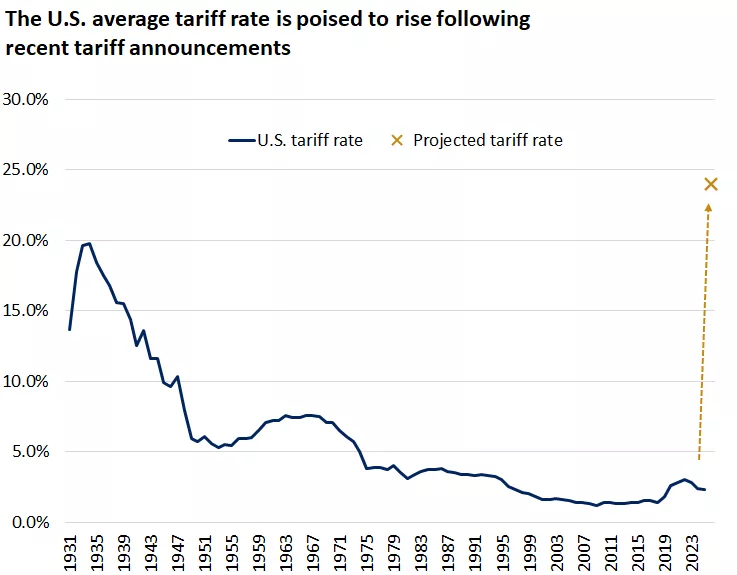

From 2000 - 2024, for example, the average U.S. tariff rate for all imports was a modest 1.7%.1 While the lower 10% rate on most countries provides some relief, the average U.S. tariff rate is still expected to jump to between 20% - 25%, as the lower 10% tariff rate is partially offset by a higher tariff rate on imports from China.2 In 2024, the U.S. economy imported roughly $3.3 trillion of goods.3 Assuming an average tariff rate of 20%, this would equate to tariff revenue of roughly $660 billion, or roughly 2.3% of 2024 GDP.3

How the incremental revenue from tariffs is used will be a key determinant of the economic impact. If a large portion of this revenue is deployed to areas that promote growth, such as financing lower taxes, economic growth could hold up better. However, if a majority of the additional tariff revenue is used to reduce the U.S. fiscal deficit, U.S. economic growth could slow more meaningfully.

This chart shows the projected average tariff rate on all U.S. imports following the April 9 tariff announcement.

This chart shows the projected average tariff rate on all U.S. imports following the April 9 tariff announcement.

Perhaps the silver lining is that the U.S. economy is entering this period of tariff uncertainty from a position of relative strength. Labor-market conditions remain healthy compared with history, and the economy has grown at an above-trend pace for the past two years. Additionally, if labor-market conditions show signs of meaningful loosening, the Fed is likely to provide support through more aggressive rate cuts.

Impact on inflation: Higher, but some mitigating factors

The current tariffs will likely put upward pressure on inflation, as domestic importers will likely pass part of the increased cost from tariffs on to the consumer. However, there are potentially mitigating factors.

- Foreign manufacturers and U.S. importers or retailers could choose to absorb part of the cost instead of passing higher prices on to the consumer. However, for certain products where profit margins are slim, such as perishable food, any additional costs are more likely to be fully passed on to the consumer.

- U.S. importers may find substitutes for products when available, and over time supply chains may be altered or brought on-shore, although the latter will require investment and more time.

- A stronger U.S. dollar can make foreign goods cheaper in U.S. dollar terms and could partially offset the impact on prices. While this was the case during the targeted tariffs of 2018-2019, the U.S. dollar has weakened year-to-date despite the threat of tariffs.

Impact on central-bank policy: The Fed could cut interest rates more than two times this year

Based on the current tariff proposal, we believe the downside risks to economic growth are more acute than the upside risks to inflation, and, therefore, the Federal Reserve will likely stand ready to ease policy if economic growth shows meaningful signs of deterioration. The markets are now reflecting the potential for three Fed cuts this year, and, in our view, the Fed could potentially cut rates more than the two times outlined at its March meeting. Keep in mind that lower interest rates should support corporate and consumer borrowing and provide a cushion for spending.

While the potential for higher inflation from the proposed tariffs may give the Federal Reserve some pause, we believe policymakers are likely to view tariffs as a one-off increase in prices as opposed to an ongoing source of inflation that would de-anchor inflation expectations, though they will closely monitor the latter. Additionally, tariffs would most directly impact goods inflation, which carries a smaller weight in the consumer price index (CPI) basket compared with services inflation.

Portfolio implications: Stay diversified, up in quality, and stay invested

Given the new tariff regime, and the higher probability of an economic downturn, investors may feel understandably nervous. However, we believe that now is not the time to abandon long-term investment strategies. History has shown us that time in the market, rather than timing yourself in and out of the market, has been the best approach to help maximize returns.

Instead, investors should focus on remaining diversified across sectors, asset classes and even regions, in quality investments. Diversification has worked well during this recent period of market volatility. Value sectors have outperformed in U.S. markets and investment-grade bonds have provided stability.

We recommend that investors maintain a balance between growth- and value-style investments, and we believe opportunities are relatively attractive in the U.S. health care and financials sectors. Health care and financials are two sectors which could be less exposed to tariffs, and financials could stand to benefit from potential deregulation and pro-growth policies down the road. Additionally, we recommend investors maintain a strategic weight in U.S. investment-grade bonds, which could help offset periods of volatility in equity markets.

Financial considerations

What can I do to prepare for tariffs?

It's important to keep in mind there are many unknowns, including which countries and goods will ultimately be impacted and for how long. That said, if you're concerned about price increases, options include revisiting your budget, refreshing your emergency fund, and considering accelerating large purchases likely to be impacted.

Revisit your budget

If you're concerned that higher prices will impact your ability to spend within your means, it's a good time to tune up your budget. If you need to make adjustments, options include:

- Substituting expenses: look for items that could easily be swapped for cheaper alternatives like generics for brand names

- Reducing expenses: see if you can cut any expenses that aren’t being used or are unnecessary

- Creating more income: explore whether there are ways to make additional income like working toward a promotion, looking for a higher-paying position, or taking on a side job

For more information about budgeting, ask your financial advisor for the "Budgeting: Take control of your spending and saving" report.

Refresh your emergency fund

An emergency fund can help with unexpected expenses, and you want to be prepared in case the cost of those expenses (like car parts) increases. We recommend having three to six months’ worth of living expenses in cash or cash equivalents for emergency needs. If you're really concerned about the uncertainty in the environment, holding the higher end of that range may be worthwhile. For more information about emergency funds, ask your financial advisor for the "Building an emergency fund" report.

Consider accelerating large purchases likely to be impacted

If you're already planning on making a large purchase that's likely to be impacted, you can accelerate the purchase if you can afford it. Examples could include automobiles or electronics like phones or computers.

Additional considerations for business owners

- Take a measured approach to the tariffs. While it's important to plan and take steps to prepare, we recommend taking a measured approach to account for the rapidly changing landscape.

- Understand and diversify your supply chain. If you rely on imports, look for opportunities to diversify your supplier base or to substitute inputs. This can give you more flexibility, reduce the probability of disruptions, and potentially reduce the impact of rising costs. You may also consider increasing inventories of durable goods prior to price increases taking effect.

- Know your pricing flexibility. If the goods you rely on become subject to tariffs, you may be able to negotiate lower prices from your suppliers. Alternatively, you might be able to pass along some of the increased costs to your customers. Their willingness to accept price increases are determined by several factors that may include things like the availability of substitute products, whether the product is a necessity or luxury, and how much of their income is allocated to the product, among other factors.

- Look for other areas to cut costs. Having a process for forecasting, budgeting, and tracking expenses can help you assess where expenses are going and potential ways to reduce them.

Sources: 1. International Trade Commission 2. Bloomberg 3. FactSet

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Mona Mahajan

Mona Mahajan is responsible for developing and communicating the firm's macroeconomic and financial market views. Her background includes equity and fixed income analysis, global investment strategy and portfolio management.

She regularly appears on CNBC and Bloomberg TV, and in The Wall Street Journal and Barron’s.

Mona has a master’s in business administration from Harvard Business School and bachelor's degrees in finance and computer science from the Wharton School and the School of Engineering at the University of Pennsylvania.

Brock Weimer

Brock Weimer is an Associate Analyst on the Investment Strategy team. He is responsible for analyzing economic data, assessing market trends, and supporting the development of resources that help clients work toward their long-term financial goals.

Meagan Dow

Meagan Dow is a senior strategist on the Client Needs Research team at Edward Jones. The Client Needs Research team develops and communicates advice and guidance for client needs, including retirement, education, preparing for the unexpected and leaving a legacy. Meagan has nearly 15 years of financial services and investment experience. She is a contributor to the Edward Jones Perspective newsletter and has been quoted in various publications.

Zach D. Gildehaus, CFA®, CFP®, CEPA® Senior Analyst, Client Needs Research

Zach Gildehaus joined Edward Jones in 2013. He is a business owner strategist on the Client Needs Research (CNR) team, where he focuses his research efforts on strategies for charitable giving and business owners.

Prior to CNR, he was a senior analyst in Investment Manager Research (IMR), where he spent more than six years covering both active and passive strategies across several asset classes.

Important information:

This content is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Diversification does not guarantee a profit or protect against loss.