Monthly portfolio brief

5 checks for your midyear checkup

What you need to know

- Trade talks have remained a key driver for markets, and easing tensions fueled a broad, strong rally in May.

- U.S. equity played catch-up to the year’s top performer — international equity — with the S&P 500 index now positive year to date despite the year’s extreme volatility.

- With the first half of 2025 largely behind us, a midyear checkup can help position your portfolio for the second half, when we expect an improving policy backdrop.

- We recommend checking your portfolio’s diversification, with a tilt toward stocks, particularly larger U.S. equities as well as the financial and health care sectors. Favoring intermediate-term investment-grade bonds may also prove beneficial.

Portfolio tip

Setting well-diversified, strategic portfolio targets can help ensure you don’t become overly exposed to the risks of any one type of investment.

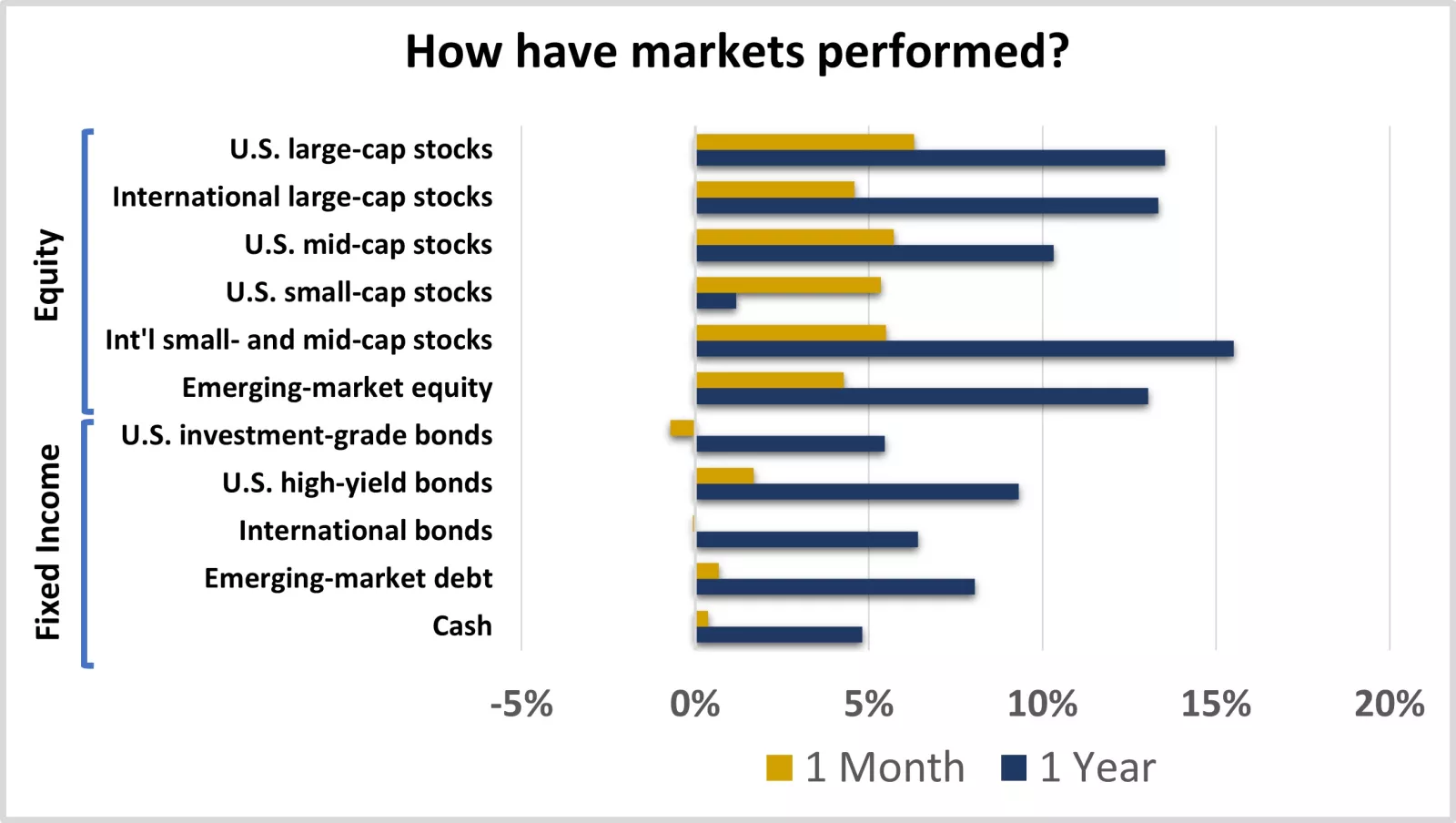

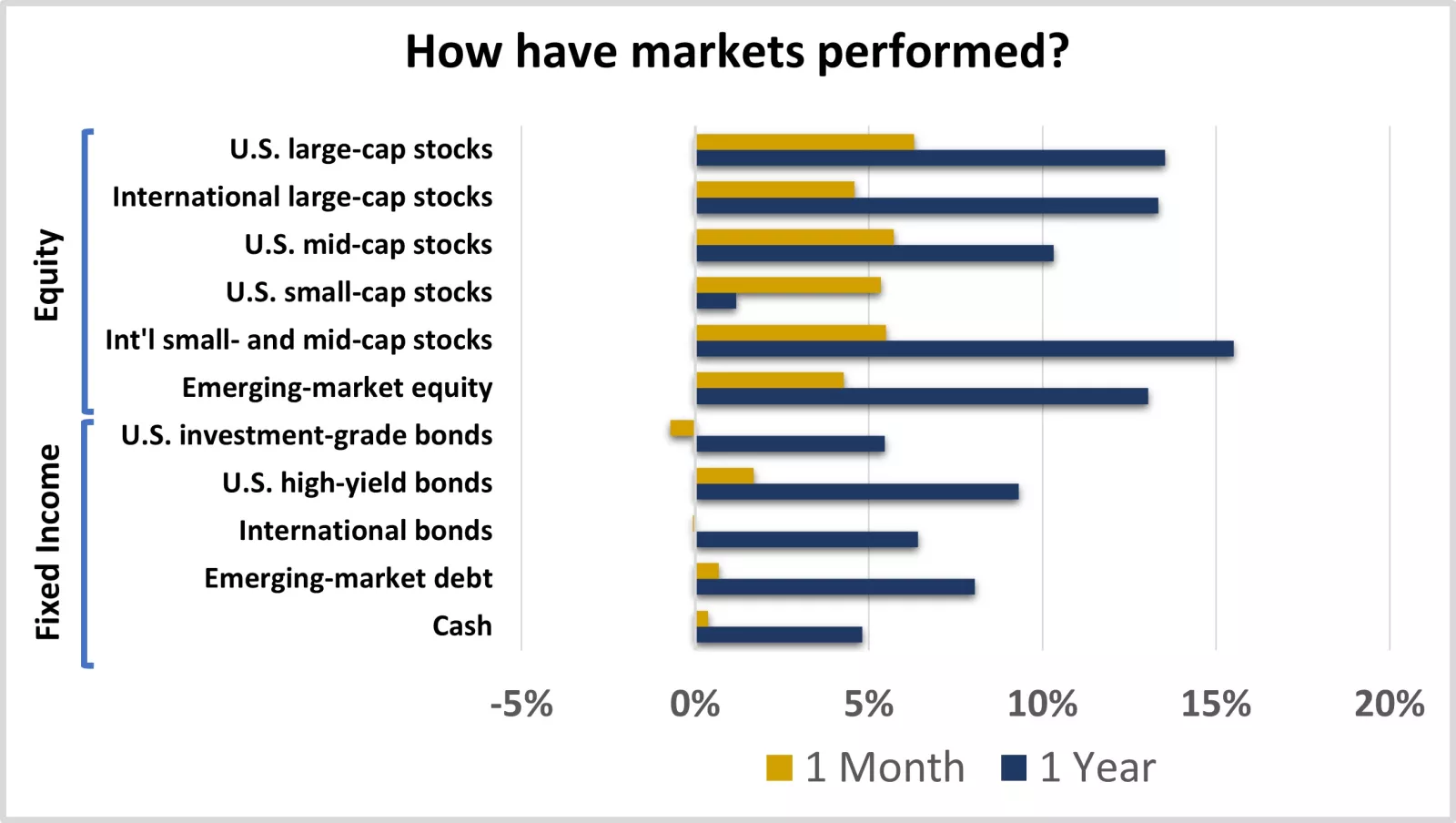

This chart shows the performance of equity and fixed-income markets over the previous month and year.

This chart shows the performance of equity and fixed-income markets over the previous month and year.

Where have we been?

Trade talks are still driving the markets, with easing tensions fueling the recent rally. It’s no surprise trade talks continued to drive markets in May. Trade relations between countries can have a meaningful impact on inflation and economic growth, and negotiations remain fluid.

But unlike in early April, when markets responded poorly to threats of significant tariff hikes, positive trade developments in May provided global stock markets fuel for an impressive rally, particularly as the impact of trade tensions on inflation and economic growth remained contained.

Among the developments, the U.S. administration made progress in deals with the UK and China, which reduced or eliminated tariffs on various products and eased non-tariff trade restrictions. The U.S. also eased trade restrictions related to artificial intelligence (AI) chips, further enabling more business with other countries.

While policy uncertainty eased in May, negotiations between countries and court challenges to tariff policies continue. This shows that trade talks may be a source of periodic volatility for markets in the months to come.

Stock market gains were broad, with nearly all asset classes now higher this year, despite trade uncertainties. Like a tide lifting all boats, last month’s generally positive trade developments helped lift domestic and international stocks across developed- and emerging-market asset classes.

International developed markets have maintained their lead year to date, with both asset classes soaring about 17%. They’ve been lifted most by their large exposure to well-performing European stocks, which have been supported by increasingly stimulative fiscal and monetary policies, as well as the additional boost from a falling dollar.

Within U.S. equity, following the May rally, large- and mid-cap stocks are now in positive territory for the year, despite their steep pullback in April. They’re both up around 1% in 2025. Small-cap stocks, on the other hand, have yet to regain the year’s losses amid growth uncertainties and higher interest rates. They’re still down 6% in 2025 and have posted only a slight gain over 12 months.

While returns were positive across nearly all U.S. sectors in May, tech-oriented sectors performed best, driven by solid earnings reports, enthusiasm around AI and relaxed tech-related trade restrictions. These sectors’ strength helped U.S. large-cap stocks end the month with a slight lead and play a bit of catch-up to international equity.

High-yield bonds outperformed higher-quality bonds amid ongoing economic resiliency. Investment-grade bonds, particularly in the U.S., were the laggards in May. Interest rates generally rose amid varying effects from easing trade tensions, growing U.S. deficit concerns, contained inflation, ongoing economic resiliency, and the Federal Reserve on hold, weighing on returns.

Lower-quality bonds, on the other hand, were cushioned by their higher yields. Credit spreads remained contained, helping U.S. high-yield bonds and emerging-market debt end the month higher and maintain their lead over the past 12 months.

What do we recommend going forward?

We recommend these five checks for your midyear checkup:

1. Check whether your strategic allocations are well-diversified and your portfolio is well-aligned. U.S. stock markets have traveled a volatile path in the first half of 2025. The path for globally diversified portfolios, however, has been smoother, given the outperformance of bonds and international stocks.

Looking ahead, returns are unknown, but the risks in a portfolio are under your control. Decide on the mix of stocks and bonds that aligns with your goals. Then set strategic allocation targets spread across a variety of asset classes, styles, sectors and bond types, while keeping your portfolio closely aligned to help ensure you don’t become overly exposed to the risks of any one type of investment.

2. Check your positioning between stocks and bonds, overweighting stocks. While keeping your strategic allocation targets in mind, we recommend reduced allocations to international bonds, shifting toward U.S. mid-cap stocks. Tariff policy negotiations remain highly uncertain and have weighed on consumer confidence, which may cause bouts of volatility. But inflation and labor markets in the U.S. have held steady, and corporate profits have demonstrated resilience.

The U.S. economy is likely to soften from last year’s above-average growth but remain solid as we head toward 2026 amid an improving trade policy backdrop, easing monetary policy and the potential for fiscal policy support. We expect this environment to benefit stocks more than bonds, particularly cyclical stocks with catch-up potential.

3. Check your positioning between international and domestic equities, overweighting U.S. stocks. We also expect U.S. large-cap stocks, which offer exposure to growth-oriented tech sectors alongside more cyclical segments of the market, to benefit from the relative strength of the U.S. economy and corporate profit growth. And they tend to be higher-quality, which can help in periods of uncertainty.

We recommend overweighting U.S. large-cap stocks by reducing allocations to international developed-market stocks, given the weaker growth prospects within international developed economies and the tendency for U.S. large-cap stocks to outperform during Fed easing cycles.

4. Check your positioning between styles and sectors, overweighting financial and health care. We continue to expect broad leadership in 2025, given the economic backdrop and the potential for earnings growth within cyclical and value-style stocks to play catch-up to mega-cap tech. We recommend neutral allocations between value- and growth-style stocks and appropriate diversification across sectors.

We view the financial services and health care sectors favorably because they appear relatively removed from tariff uncertainty and are likely to benefit from a resilient economy if growth remains solid as we expect. Consider reallocating from consumer staples and materials.

5. Check your positioning within bonds, targeting higher interest rate sensitivity. Diversifying across short-, intermediate- and long-term bonds can help you manage how interest rate fluctuations may impact your portfolio over time.

We expect the Fed to resume its rate-cutting cycle later this year, and the 10-year Treasury has recently moved toward the upper end of the 4%–4.5% range we generally expect for 2025. We recommend favoring seven- to 10-year maturities within U.S. investment-grade bonds, reallocating from shorter-term bonds and certificates of deposit (CDs), given their reinvestment risk.

We’re here for you

With the first half of 2025 largely behind us, a midyear checkup can help position your portfolio for the second half, when we expect an improving policy backdrop, though not without periodic volatility. Talk with your financial advisor about diversification and rebalancing strategies that can help keep you prepared, and how our team of investment professionals and opportunistic portfolio guidance can provide additional support.

If you don’t have a financial advisor, we invite you to meet with an Edward Jones financial advisor to help you create a well-diversified investment strategy according to your financials goals, and check that your portfolio is closely aligned and opportunistically positioned as we head toward the back half of 2025.

Strategic portfolio guidance

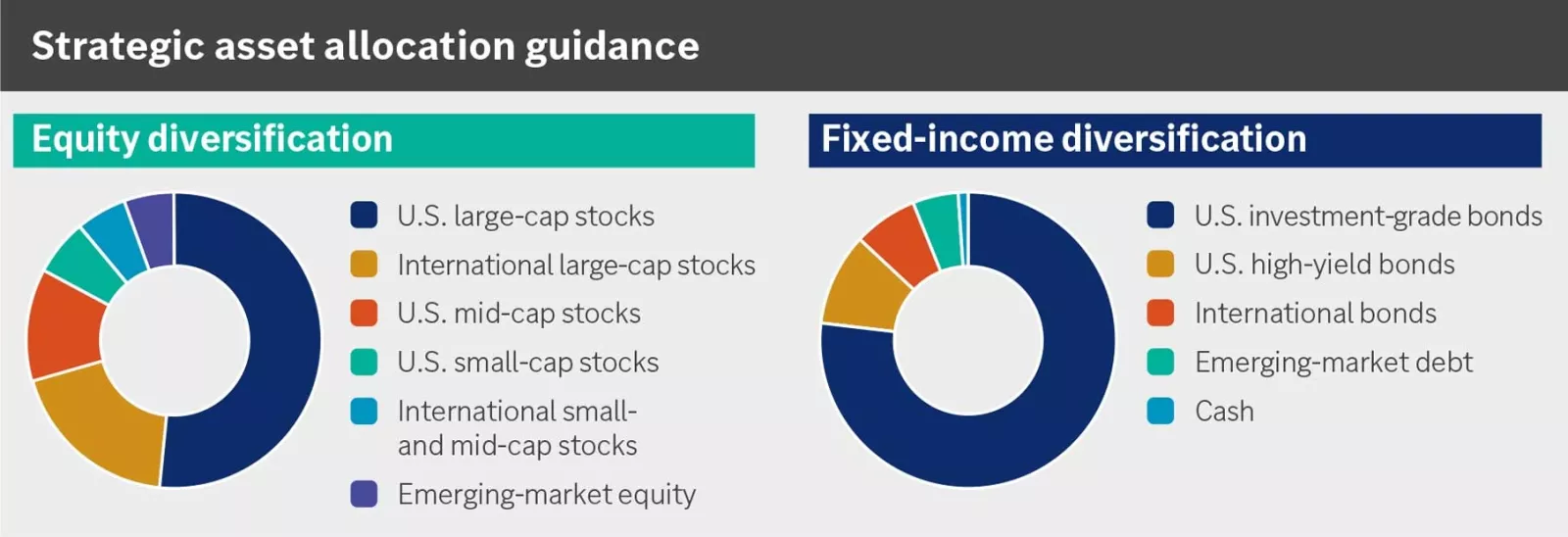

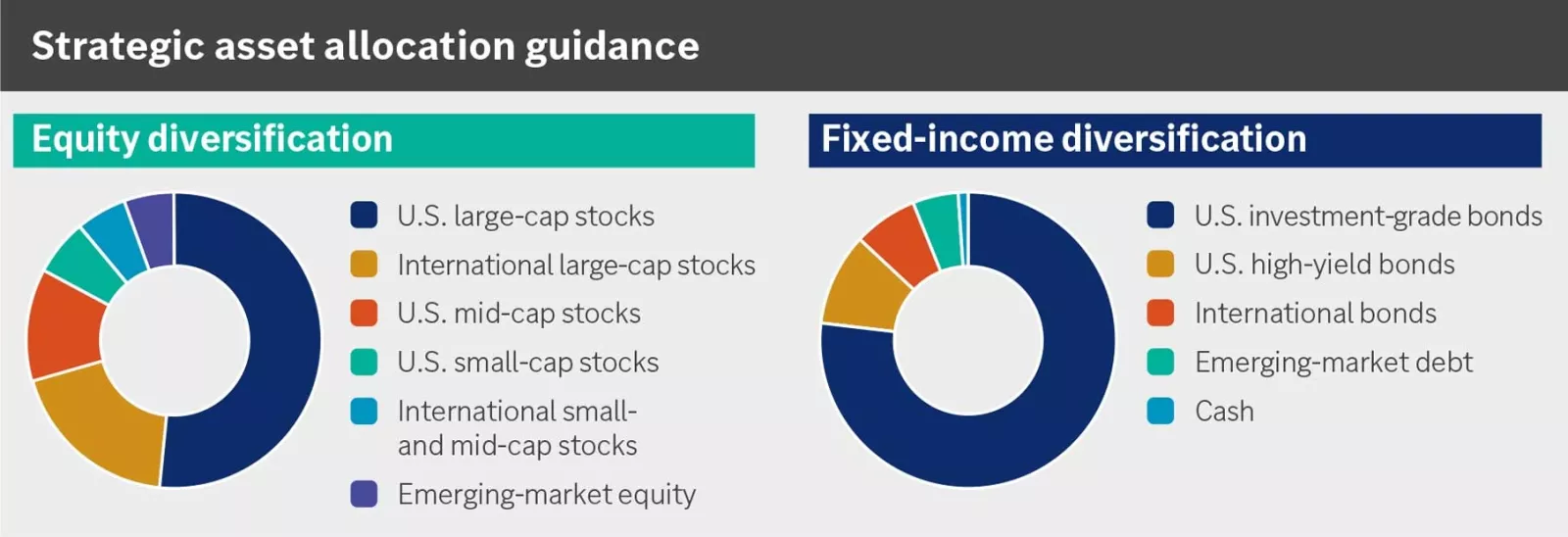

Defining your strategic investment allocations helps to keep your portfolio aligned with your risk and return objectives, and we recommend taking a diversified approach. Our long-term strategic asset allocation guidance represents our view of balanced diversification for the fixed-income and equity portions of a well-diversified portfolio, based on our outlook for the economy and markets over the next 30 years. The exact weightings (neutral weights) to each asset class will depend on the broad allocation to equity and fixed-income investments that most closely aligns with your comfort with risk and financial goals.

Diversification does not ensure a profit or protect against loss in a declining market.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Within our strategic guidance, we recommend these asset classes:

Equity diversification: U.S. large-cap stocks, international large-cap stocks, U.S. mid-cap stocks, U.S. small-cap stocks, international small- and mid-cap stocks, emerging-market equity.

Fixed-income diversification: U.S. investment-grade bonds, U.S. high-yield bonds, international bonds, emerging-market debt, cash.

Opportunistic portfolio guidance

Our opportunistic portfolio guidance represents our timely investment advice based on current market conditions and a shorter-term outlook. We believe incorporating this guidance into a well-diversified portfolio may enhance your potential for greater returns without taking on unintentional risks, helping keep your portfolio aligned with your risk and return objectives. We recommend first considering our opportunistic asset allocation guidance to capture opportunities across asset classes. We then recommend considering opportunistic equity style, U.S. equity sector and U.S. investment-grade bond guidance for more supplemental portfolio positioning, if appropriate.

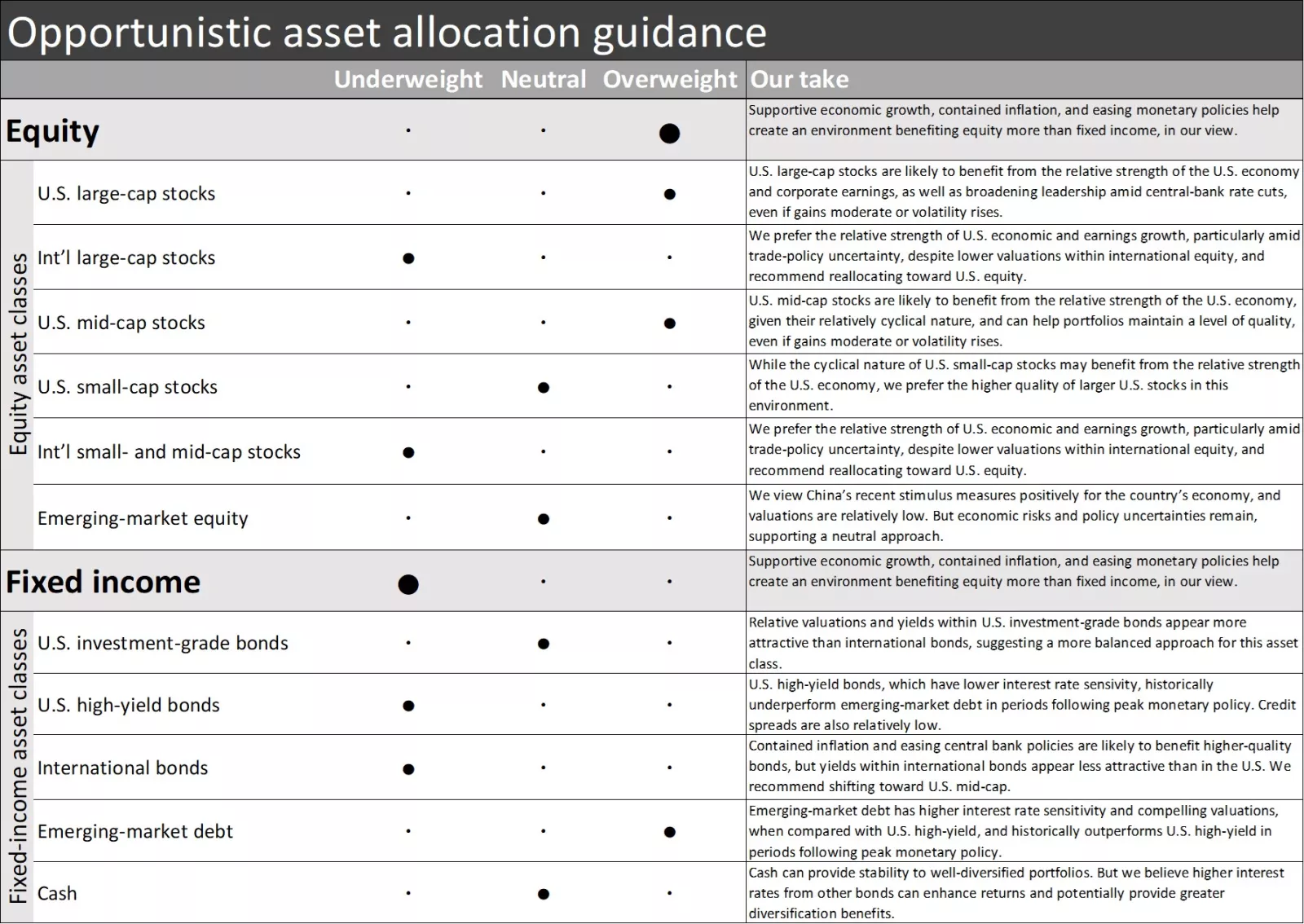

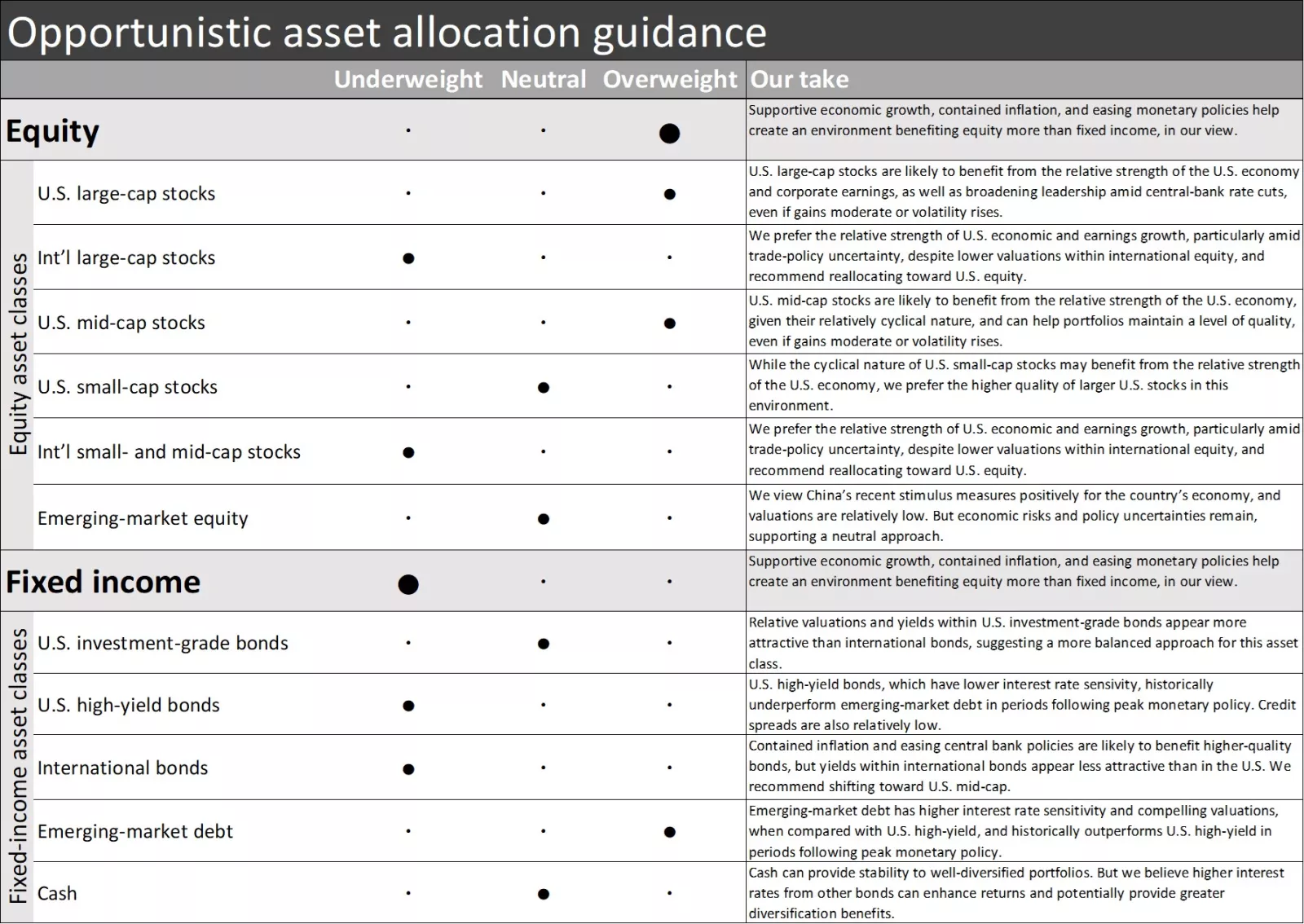

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks and U.S. mid-cap stocks; neutral for U.S. small-cap stocks and emerging-market equity; underweight for international large-cap stocks and international small- and mid-cap stocks.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for U.S. investment-grade bonds and cash; underweight for U.S. high-yield bonds and international bonds.

Our opportunistic asset allocation guidance follows:

Equity — overweight overall; overweight for U.S. large-cap stocks and U.S. mid-cap stocks; neutral for U.S. small-cap stocks and emerging-market equity; underweight for international large-cap stocks and international small- and mid-cap stocks.

Fixed income — underweight overall; overweight for emerging-market debt; neutral for U.S. investment-grade bonds and cash; underweight for U.S. high-yield bonds and international bonds.

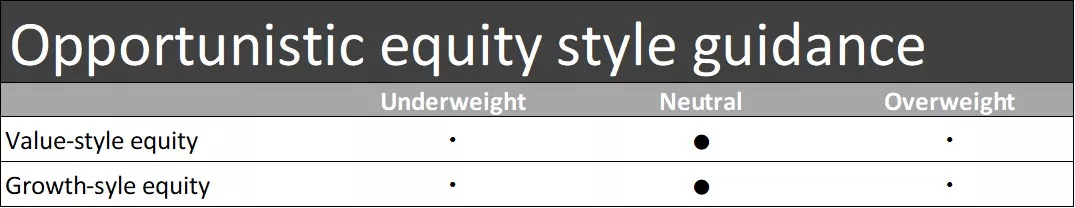

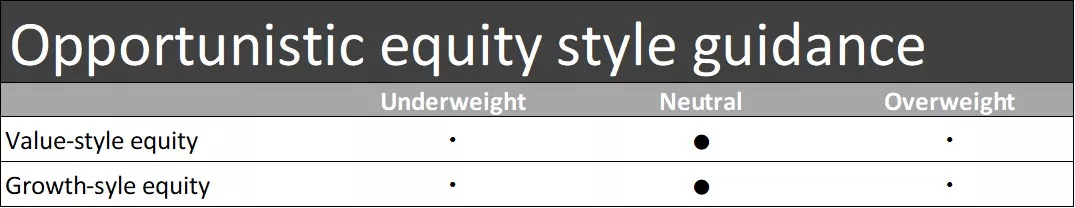

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

Our opportunistic equity style guidance is neutral for value-style equity and growth-style equity.

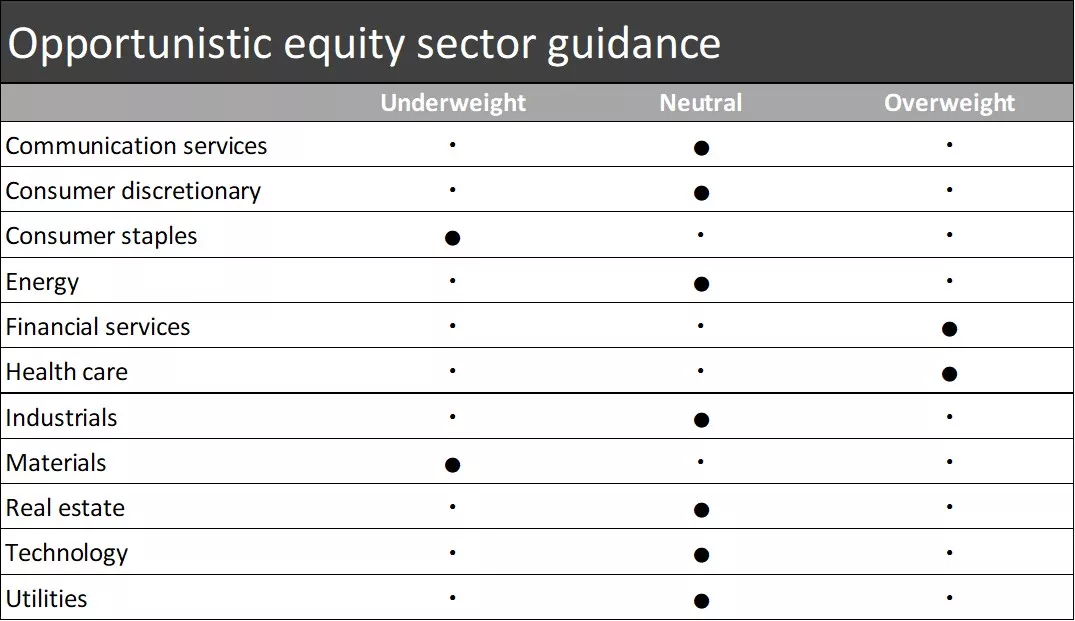

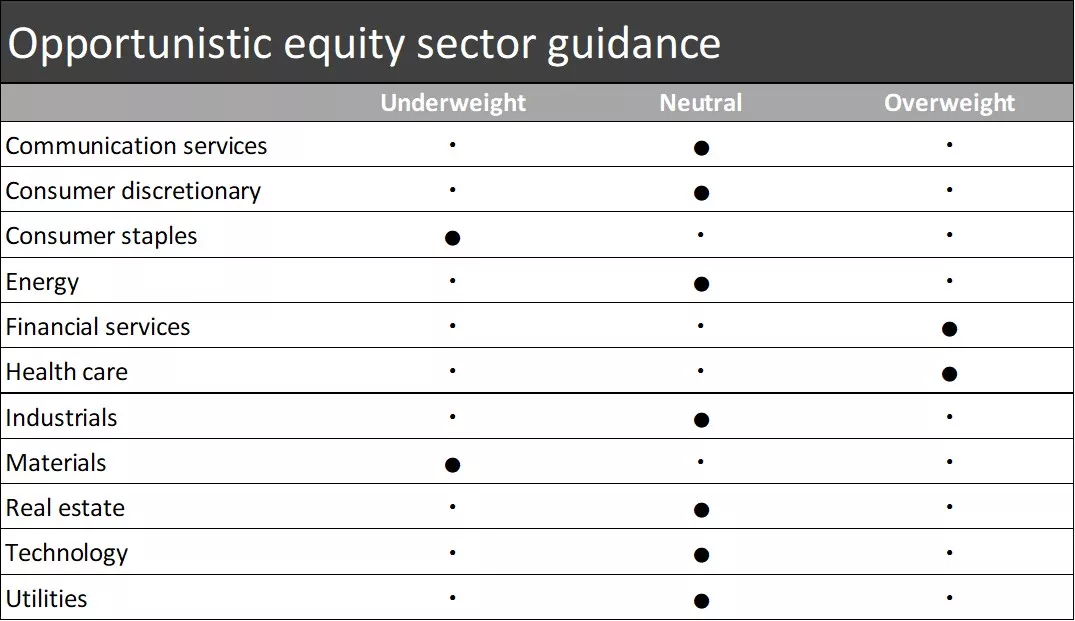

Our opportunistic equity sector guidance follows:

• Overweight for financial services and health care

• Neutral for communications services, consumer discretionary, energy, industrials, real estate, technology and utilities

• Underweight for materials and consumer staples

Our opportunistic equity sector guidance follows:

• Overweight for financial services and health care

• Neutral for communications services, consumer discretionary, energy, industrials, real estate, technology and utilities

• Underweight for materials and consumer staples

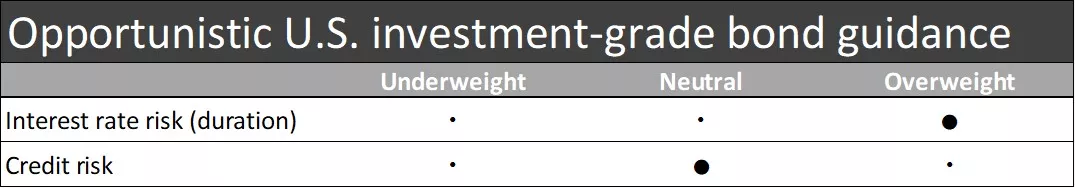

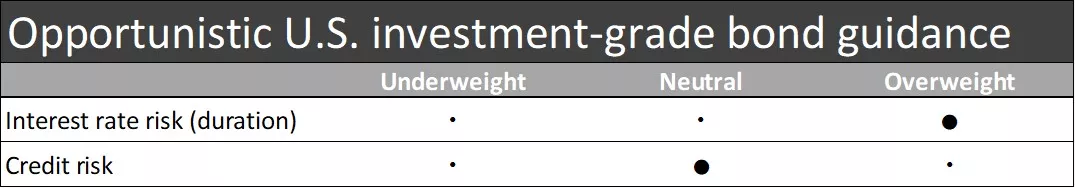

Our opportunistic U.S. investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Our opportunistic U.S. investment-grade bond guidance is overweight in interest rate risk (duration) and neutral in credit risk.

Tom Larm, CFA®, CFP®

Tom Larm is a Portfolio Strategist on the Investment Strategy team. He is responsible for developing advice and guidance related to portfolio construction, asset allocation and investment performance to help clients achieve their long-term financial goals.

Tom graduated magna cum laude from Missouri State University with a bachelor’s degree in finance. He earned his MBA from St. Louis University, is a CFA charterholder and holds the CFP professional designation. He is a member of the CFA Society of St. Louis.

Important information

Past performance of the markets is not a guarantee of future results.

Diversification does not ensure a profit or protect against loss in a declining market.

Investing in equities involves risk. The value of your shares will fluctuate, and you may lose principal. Mid- and small-cap stocks tend to be more volatile than large-company stocks. Special risks are involved in international and emerging-market investing, including those related to currency fluctuations and foreign political and economic events.

Rebalancing does not guarantee a profit or protect against loss and may result in a taxable event.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

The opinions stated are for general information purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.