Most people won’t be eligible for Medicare before age 65, but many will retire before then

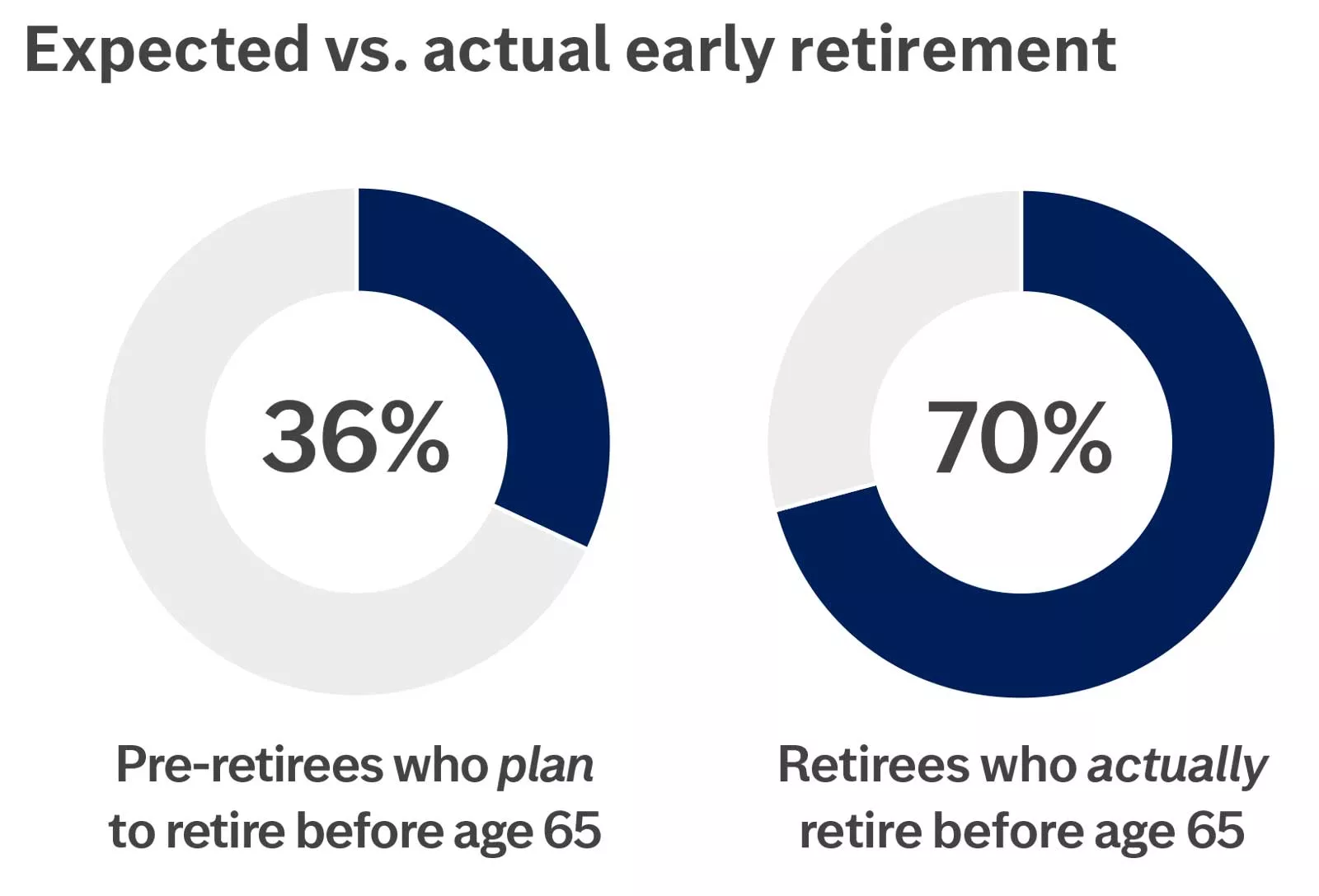

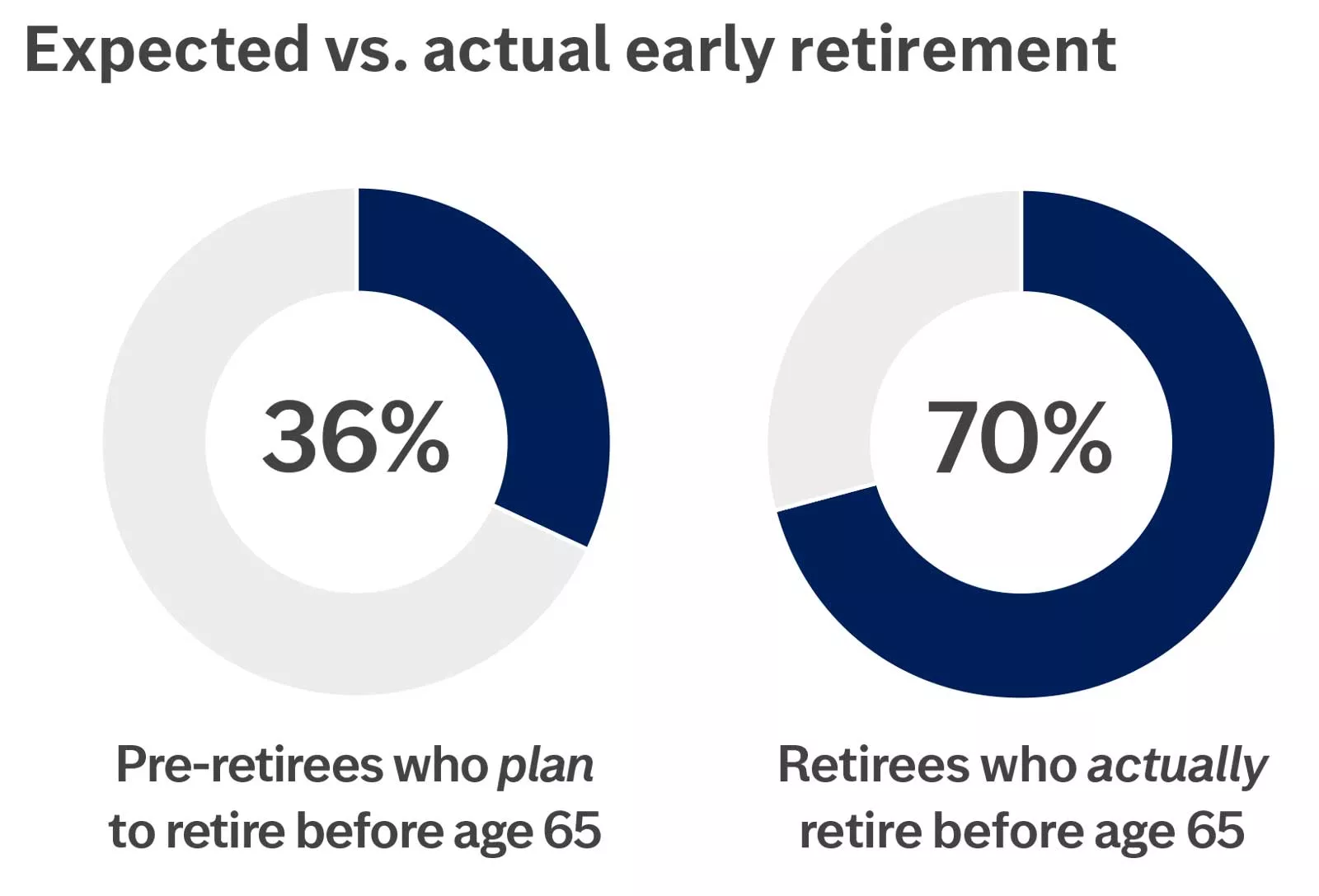

Early retirement can be planned, but it’s often unexpected. More than three in 10 pre-retirees say they plan to retire before 65. But many retire sooner than they intended. So, even if you plan on retiring at or after age 65, you’ll want to understand your health insurance options.

This chart shows 36% of pre-retirees plan to retire before age 65, but 70% of retirees actually retire before age 65.

This chart shows 36% of pre-retirees plan to retire before age 65, but 70% of retirees actually retire before age 65.

Potential reasons people may unexpectedly retire early include:

- Job loss

- Unhappy with their current job

- Poor health – their or a loved one's

- Spouse retires

- Financially ready to retire earlier than expected

If at all possible, have health insurance

Since most people get their health care insurance from their employers, retiring before 65 – whether planned or not – can mean a coverage gap. Finding health insurance during that gap may be expensive, but not having coverage could be even more costly and lead to poor health and well-being.

- Hospitals frequently charge two to four times the amount health insurers/public programs pay for hospital services.2

- Uninsured adults are more likely to face negative financial consequences from medical bills.2

- Many uninsured individuals avoid seeking medical care, contributing to overall lower health and well-being.3

When you consider all the negative consequences of not having insurance, it’s easy to see why it’s so important to maintain health care insurance and incorporate expected medical costs into your retirement plans.

We recommend exploring four main options for health insurance. They’re ordered from what generally are the cheapest to the most expensive options, but not everyone will have access to each option and the coverage and costs will vary.

Health insurance options, pros and cons

| Pros | Cons | |

|---|---|---|

| Former Employer Retiree Health Benefits |

|

|

| Spouse's Plan |

|

|

| COBRA |

|

|

| ACA Marketplace Plan |

|

|

Less Common Options

- Medicaid – Not typically an option to plan for due to income and asset restrictions to qualify.

- Medicare – May be an option for certain individuals younger than 65 with a disability, end-stage renal disease or Lou Gehrig's Disease (ALS).

- Military – Those who served in the military may be eligible for TRICARE or VA Health Care.

Generally Less Attractive Options

- Moving abroad – Other countries may offer health coverage options, but moving isn’t desirable for many people.

- Off-exchange plans (private plans) – Usually more expensive than an ACA plan.

- Faith-based health sharing plans – Not actually insurance and the plans have limitations, so generally not a desirable alternative to health insurance.

While Edward Jones doesn’t provide advice as to which health insurance plan is most appropriate, there are many things to consider as you’re weighing your options, including:

Coverage

- Provider/facility network – Look up whether your desired providers and facilities are in-network.

- Prescription coverage for specific medications – Check medication coverage and pricing details.

- Benefits coverage – Ensure coverage for specific services you expect to rely on (for example, weight management or mental health needs).

Cost

- It’s important to compare the entire spectrum of costs for different plans, including:

- Premiums.

- Cost sharing when you use your plan (like deductibles, copays and coinsurance).

- Out-of-pocket maximum.

Access to a Health Savings Account (HSA)

- There are many benefits to having an HSA, but one of the requirements for contributing to one is being covered by a High Deductible Health Plan (HDHP).

- If contributing to an HSA is beneficial for you, an HDHP might be a favorable option.

Whether you hope to retire in five years or 15, now is the time to start planning for health insurance. Start by determining how long you’ll need coverage and how much that coverage might cost you.

How long?

If you’re planning to retire early, ensure you’re accounting for the cost of health care in the years before you’re eligible for Medicare (age 65 for most individuals). Your financial advisor can help build health care costs – both before you turn 65 and once you become eligible for Medicare – into your retirement plan.

Even if you’re planning on working until at least age 65, you may still want your financial advisor to run scenarios in which you retire earlier than expected. The median age for retirement is 624, so planning for at least three years of unexpected health care expenses before Medicare eligibility is a good way to stress test your plan.

How much?

If you’re close to retirement, you may be able to estimate your costs more precisely. You’ll want to estimate your premiums as well as expected out-of-pocket costs.

- Contact your employer’s HR department for information about retiree benefits and COBRA coverage.

- Contact your spouse’s HR department for information about spousal coverage options.

- Check into ACA Marketplace plans at healthcare.gov.

If you’re further away from retirement, you may just want to use estimates. Be sure to adjust for inflation.

- Employer Coverage: If you expect to continue employer coverage estimate around $10,000 per year per person.

- ACA Marketplace Coverage: If you think you may need to rely on an ACA Marketplace plan, the cost will depend on a variety of factors including your location, age, smoking status and income. As a starting point, assume around $15,000 annually per person.

Incorporating these costs can help ensure you can keep health insurance and afford necessary health care in your early retirement years.