How to help reduce your tax liability next year

For many people, the thought of a refund keeps them on the edge of their seat during tax season. But paying more taxes than anticipated or, worse, owing more money can become a harsh reality for others. If this sounds familiar, it may be time to make some strategic adjustments so next year’s tax season isn’t so frustrating.

Below we highlight different opportunities to help you avoid unwanted surprises at tax time. As you consider these strategies, remember that reducing taxes may have an immediate financial benefit, but tax planning shouldn’t take priority over your long-term financial goals.

Reduce taxable income

Since your tax liability is based on your taxable income, reducing your taxable income reduces your overall tax bill. The following considerations can help you accomplish this while staying on track with your long-term goals.

Increase contributions to pretax, tax-advantaged accounts

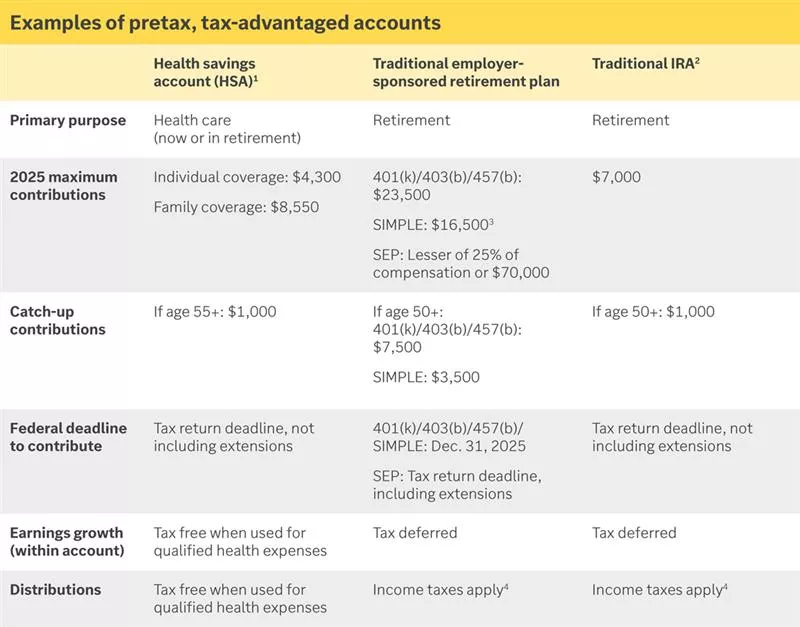

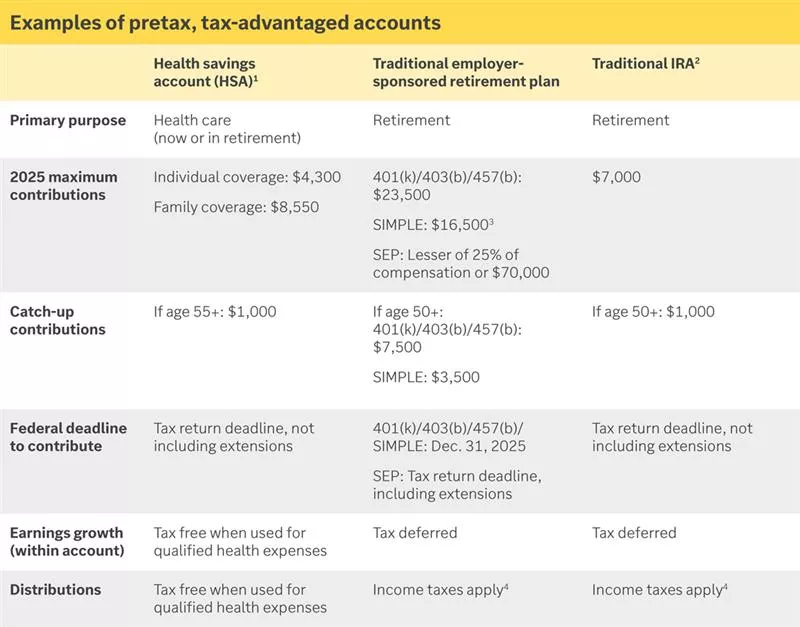

Contributing to pretax, tax-advantaged accounts allows you to invest toward your long-term goals and receive a current-year tax benefit. Increasing or maximizing contributions to these accounts reduces your taxable income so long as you follow the rules and limitations applicable to each account type.

The table above outlines three types of pretax, tax-advantaged accounts, including a Health Savings Account (HSA), traditional employer-sponsored retirement plan, and a traditional IRA. The table outlines each account's primary purpose, 2025 contribution limit and catch-up contribution limit, 2025 deadline to contribute, as well as earnings growth and distributions.

The table above outlines three types of pretax, tax-advantaged accounts, including a Health Savings Account (HSA), traditional employer-sponsored retirement plan, and a traditional IRA. The table outlines each account's primary purpose, 2025 contribution limit and catch-up contribution limit, 2025 deadline to contribute, as well as earnings growth and distributions.

1 You must meet certain eligibility requirements to contribute.

2 To receive the full deduction for traditional IRA contributions, your income must fall below a certain threshold.

3 Certain plans can contribute 110% of contribution limits. Consult your plan administrator.

4 Early withdrawals are subject to an additional 10% penalty.

Consider tax-efficient investment strategies

- Tax-loss harvesting — Recognizing losses on the sale of investments allows you to reduce capital gains recognized throughout the year. Losses exceeding capital gains can offset $3,000 of ordinary income and then be carried into future years to reduce future gains. Before harvesting losses, though, consider the limitations imposed by the wash-sale rule.

- Avoid high turnover in taxable accounts — Frequent trading in taxable accounts can lead to more frequent gain recognition and higher taxes. Plus, if your holding period is one year or less, your gains will be taxed at your marginal tax rate instead of the more favorable capital gains rate. A short holding period could even disqualify the investment’s dividends from being taxed at your long-term capital gains rate.

- Consider municipal bonds for your taxable accounts — Since interest on municipal bonds isn’t subject to federal (and potentially state and local) tax, holding these investments in your taxable account can help you maintain a suitable level of fixed income without recognizing the tax implications of that income. However, be aware that certain municipal bonds may result in alternative minimum tax consequences if your income is above a certain level.

If you’re charitably inclined, consider increasing donations

- Qualified charitable distributions (QCDs) — If you’re 70½ or older, you can donate up to $108,000 to a qualifying charity directly from your IRA. Qualifying donations will be excluded from your taxable income and can help satisfy any applicable required minimum distributions.

- Charitable contribution deduction — If you itemize your deductions, additional charitable contributions can increase your itemized deductions and reduce your taxable income. One way this can be accomplished is by “bunching” charitable contributions, which involves making two or more years’ worth of charitable donations in one year. Bunching can also help those who don’t typically itemize their deductions, as a large donation in one year may allow you to itemize your deductions that year and capitalize on the standard deduction the following year.

Increase tax payments

While the above opportunities may help lower your taxes for the year, you may still be concerned about owning money during tax season or incurring underpayment penalties. If this is the case, it may be worth increasing your tax payments throughout the year.

Below, we outline two options for increasing your yearly tax payments. It’s important to understand that while these strategies do not affect the total taxes you pay for the year, they do affect the timing of when those taxes are paid, which may prevent any underpayment penalties on your tax return.

Consider updating your W-4

The W-4 serves as a way for employees to document their specific personal tax situation, including their filing status, whether they have dependents, work multiple jobs or have itemized deductions. Employers then use this information to determine the amount of your paycheck to withhold for taxes. Since W-4s can be updated with employers at any time throughout the year, you can conveniently adjust your withholding to cover your estimated yearly tax.

Consider making estimated tax payments

If you’re self-employed and don’t receive a W-4, a meaningful portion of your income is from bonuses or investments, or you just don’t want to reduce your net pay on your paycheck, you can choose to make quarterly estimated tax payments, due on April 15, June 16 and Sept. 15 of 2025 and Jan. 15, 2026.

We’re here to help

Taking proactive steps throughout the year to manage your taxes can help you reduce your tax liability and avoid a surprise at tax time. Your financial advisor and tax professional can help you determine which strategies make sense for you.

Important information:

Edward Jones, its employees and financial advisors cannot provide tax advice. You should consult your qualified tax advisor regarding your situation.