3 things to know about inherited IRAs in 2025

The SECURE (Setting Every Community Up for Retirement Enhancement) Act of 2019 significantly changed beneficiary payout options for certain inherited individual retirement accounts (IRAs). In July 2024, the IRS released regulations that clarified the interpretation of the 2019 Act. Understanding these rules is important whether you’re naming beneficiaries for your own IRA or have inherited an IRA from an account owner who died on or after Jan. 1, 2020. In particular, if you’ve inherited an IRA after 2019, you might have a required minimum distribution (RMD) obligation beginning this year.

1. When you inherit an IRA, you must take distributions by a certain deadline.

When you inherit an IRA, IRS rules dictate the amount you’re required to take out of the IRA and by when — referred to as your payout options. The primary payout options for deaths after 2019 are the “stretch” or the 10-year rule. The stretch option allows the beneficiary to withdraw assets over a lifetime through annual payments, while the 10-year rule requires the IRA balance to be depleted by Dec. 31 of the year containing the 10th anniversary of the original account owner’s date of death. A beneficiary’s payout options are based on the original account owner’s date of death, beneficiary type and whether the original owner died before, on or after their required beginning date (RBD) for their required minimum distributions (RMDs). Some beneficiaries are eligible to choose between payout options.

2. Beginning in 2025, certain beneficiaries subject to the 10-year rule must take RMDs during the 10-year period.

The SECURE Act limited the ability to stretch RMDs for most nonspouse beneficiaries and introduced the 10-year rule. However, when the rule was released, it wasn’t clear if annual RMDs were required during the 10-year period or if the rule could be satisfied by depleting the entire account balance in the 10th year.

The July 2024 regulations clarified that if you inherited an IRA from someone who reached their RBD and you’re subject to the 10-year rule, you must take annual RMDs during the 10-year period. If the original owner passed away before reaching their RBD, annual distributions generally aren’t required.

Because of the uncertainty, RMDs for beneficiaries subject to the 10-year rule were waived for calendar years 2021–2024 and penalties were not assessed. However, failure to take RMDs in 2025 or after will result in a penalty up to 25% on the RMD amount not taken.

3. Taking more than the required minimum amount could reduce your overall tax bill.

While it may be tempting to defer distributions as long as possible, taking more than the required amount could create tax savings over time.

Consider the following hypothetical example. This example is for illustrative purposes only.

Emily (age 42) is single and earns $120,000 per year. In 2023, she inherited an IRA valued at $800,000 as of Dec. 31, 2023. Emily is subject to the 10-year rule and isn’t required to take annual RMDs. Her investment return is 6% per year, and she’s in the 24% tax bracket. She’d like to evaluate different distribution approaches.

Strategy #1: Take nothing until year 10.

Wait until year 10 to take a full distribution.

Strategy #2: Take RMDs each year.

Take a distribution equal to an RMD based on her life expectancy in years 1–9 and deplete the remainder of the balance in year 10.

Strategy #3: Take a relatively proportionate distribution or “1/n” until year 10.

Divide the account value at the beginning of each year by the number of years left in the 10-year period. For example, in year 1, divide the account value by 10; in year 2, divide the account value by 9; and so on. In year 10, deplete the remainder of the balance.

Strategy #4: Maximize tax bracket until year 10.

Maximize the 24% bracket by taking enough from her IRA to fill out her tax bracket each year and take the remainder in year 10.

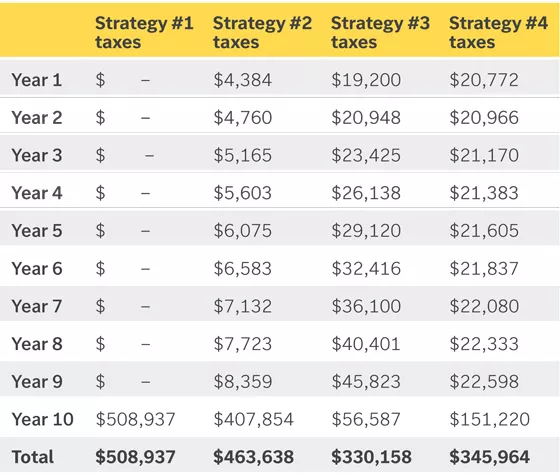

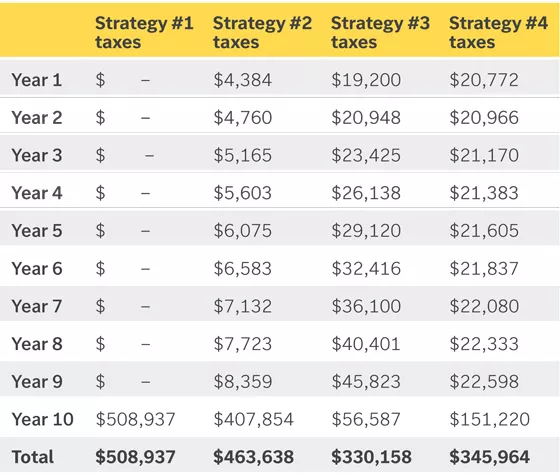

The table below shows the additional taxes Emily would owe for each strategy.

The chart below outlines four different tax strategies for someone who has inherited an IRA worth $800,000 subject to the 10-year rule, and the additional amount they would owe based on each. Strategy #1 is to take nothing until year 10 ($508,937 owed); strategy #2 is to take RMDs each year ($463,638 owed); strategy #3 is to take a relatively proportionate distribution or "1/n" until year 10 ($330,158 owed); and strategy #4 is to maximize their tax bracket until year 10 ($345,964 owed).

The chart below outlines four different tax strategies for someone who has inherited an IRA worth $800,000 subject to the 10-year rule, and the additional amount they would owe based on each. Strategy #1 is to take nothing until year 10 ($508,937 owed); strategy #2 is to take RMDs each year ($463,638 owed); strategy #3 is to take a relatively proportionate distribution or "1/n" until year 10 ($330,158 owed); and strategy #4 is to maximize their tax bracket until year 10 ($345,964 owed).

Planning for inherited IRAs is complex with many factors to consider. Work with your financial advisor to understand inherited IRA payout options and how they impact your financial goals.

Important information:

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult with your attorney or qualified tax advisor regarding your situation. Content is intended as educational only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation.