5 education savings account options

When it comes to the best plan for your child’s future and your education savings strategy, there are several options to consider.

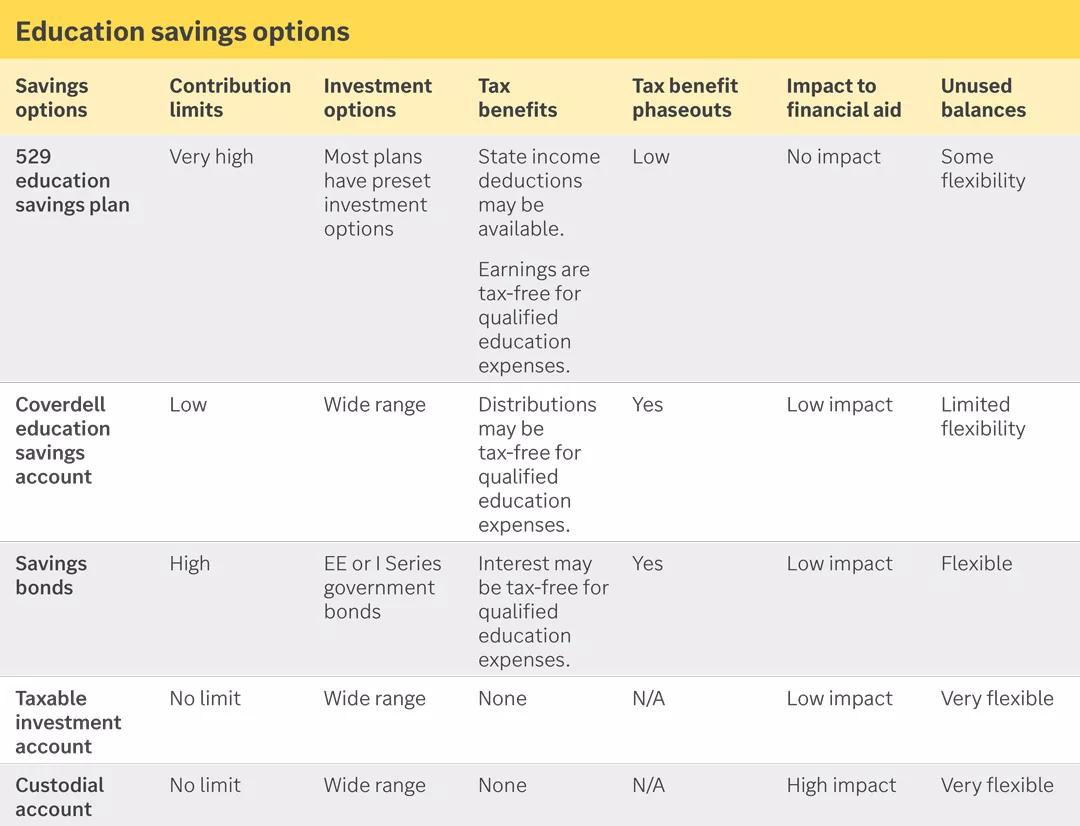

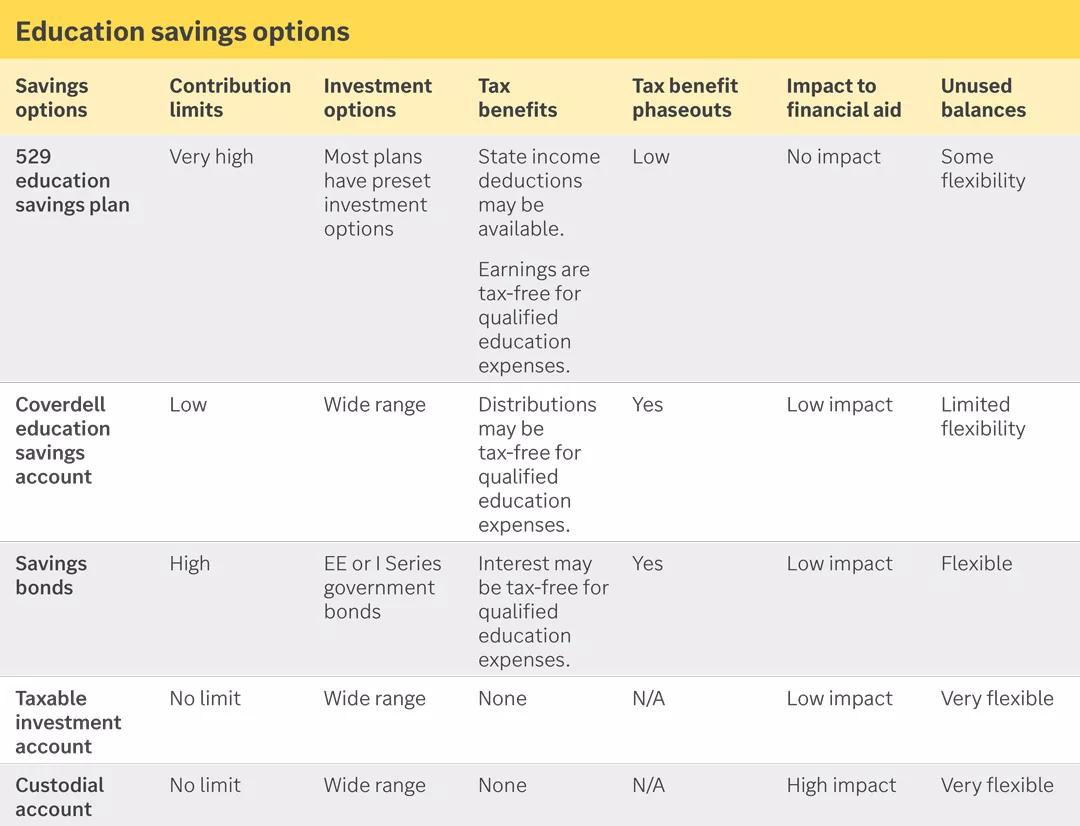

The chart above outlines each of the five education savings options, as well as their corresponding contribution limits, investment options, tax benefits, tax benefit phaseouts, impact to financial aid, as well as the level of flexibility with unused balances.

The chart above outlines each of the five education savings options, as well as their corresponding contribution limits, investment options, tax benefits, tax benefit phaseouts, impact to financial aid, as well as the level of flexibility with unused balances.

529 education savings plans

What is a 529 education savings plan?

A 529 education savings plan is a commonly used option for elementary, secondary and higher education expenses, apprenticeships and student loan repayment.

How 529 plans work

A 529 plan can help beneficiaries of any age with qualified education expenses. Additionally, anyone can contribute to this account. Contributions are treated as gifts, so consider staying within the annual gifting limit ($19,000 for single filers and $38,000 for married filing jointly in 2025). A super funding provision allows for up to five times the annual gifting amount. Each state sponsors different plans with their own investment options, but you’re not limited to your home state’s plan.

Taxes on 529 plans

529 contributions aren’t deductible for federal income taxes, but many offer state income tax deductions for contributions. Earnings grow tax free, and when used for qualified education expenses, distributions are federally tax-free.

Coverdell education savings accounts

What is a Coverdell account?

A Coverdell education savings account can be used toward elementary, secondary and higher education expenses.

How Coverdell accounts work for education

A Coverdell account may be established for a beneficiary younger than 18 (or for a beneficiary with special needs). Contributions are generally limited to $2,000 per year, per child, until the child reaches age 18. Students may be eligible for a full contribution, a reduced contribution or no contribution at all, depending on your modified adjusted gross income (MAGI) for the year.

Taxes on Coverdell accounts

Coverdell contributions aren’t tax-deductible, but earnings grow tax free. When used for qualified education expenses, distributions are federally tax-free.

Savings bonds

What is a savings bond?

Savings bonds are issued by the U.S. Department of the Treasury and backed by the U.S. government. They may be purchased online from the Treasury.

How savings bonds work for education

Purchases of series EE or I bonds are limited to $10,000 per year, per Social Security number and bond type, plus an additional $5,000 in paper I bonds if you use your tax return for the purchase. The owner must be at least 24 at the time of purchase to qualify for education-related tax benefits. When the bond matures, it’s redeemed for that exact amount. Proceeds and interest can help cover education expenses.

Taxes on savings bonds

Bond earnings may not have to be claimed as income for income tax purposes as long as proceeds are used for qualified education expenses — with certain restrictions. Income limits may restrict your ability to receive tax-free income.

Taxable investment accounts

What is a taxable investment account?

Taxable investment accounts are savings accounts set up through a financial institution.

How taxable investment accounts work for education

A portfolio of personal investments can be earmarked for college savings, and there are no contribution limits. To help with asset allocation, you may want to identify exactly how much you’ve saved for education or use a separate account solely for this purpose.

Taxes on investment accounts

Although there aren’t any tax benefits, there are also no penalties when using the account for noneducation expenses. All earnings are taxed at the account owner’s regular rate.

Custodial accounts

What is a custodial account?

A custodial account can be opened for a minor and controlled by an adult custodian until the minor reaches the age of termination (typically 18 or 21, though some state laws allow an older age). Contributions are irrevocable, and the beneficiary can’t be changed. Once account control transfers to the beneficiary, the money can be used at their discretion.

How custodial accounts work for education

There aren’t contribution limits with a custodial account. Funds can provide minors with cash or help build investment assets to pay for college expenses. Custodial accounts have no distribution limits, but funds must be used solely for the beneficiary.

Taxes on custodial accounts

Earnings are taxed at the minor’s tax rate, up to a certain point, after which they’re taxed at the parents’ marginal rates. Once the minor reaches the age of majority, the account is fully taxable at their rate. Withdrawals are taxed, even if used for education expenses.

How Edward Jones can help

Edward Jones is committed to offering comprehensive education savings strategies based on your unique financial needs. We’ll work to understand your personal short- and long-term goals and build a customized financial strategy to help you get there. Find an Edward Jones financial advisor today to get started.

Important information:

Edward Jones, its employees and financial advisors cannot provide tax or legal advice. You should consult your attorney or qualified tax advisor regarding your situation. Content is intended for education only and should not be relied on for other than broadly informational purposes. Investors should make investment decisions based on their unique investment objectives and financial situation.