Weekly market wrap

Summer test ahead: Economy and markets show resilience

Key takeaways:

- Despite some signs of cooling, the U.S. May jobs data came in better than expected, easing concerns about a sharp economic slowdown amid ongoing tariff headwinds. In Canada, despite a surprise increase in total employment, the labour market is weakening which could lead the BoC to return to rate cuts after keeping policy unchanged at the June meeting.

- Markets have rebounded impressively, with global equities hitting new highs, up 20% since the April lows, supported by solid fundamentals, easing trade tensions, and strong corporate earnings.

- While valuations have undoubtedly contributed to the recent gains and potentially indicate some complacency, earnings have also played an important role in supporting the rally from the bottom, especially within mega-cap tech.

- Risks remain from trade and policy uncertainty, including tariff deadlines, central bank rate decisions, and the U.S. debt-ceiling debate. Volatility may increase, but resilience in fundamentals helps provide a strong foundation.

Summer isn't typically associated with tests – but this year may be an exception for markets. After a solid run supported by resilient fundamentals, investors now face a season that could bring meaningful catalysts. From potential trade developments and tariff headlines to evolving central-bank policy and fiscal debates, the months ahead may test the recent momentum and shape the market's direction for the second half of the year.

We share our take on the latest employment reports in Canada and the U.S., the first major economic releases of the summer, and our view on where key drivers stand ahead of a likely eventful next couple of months.

Canada's labour market holds up, though tariffs pinch

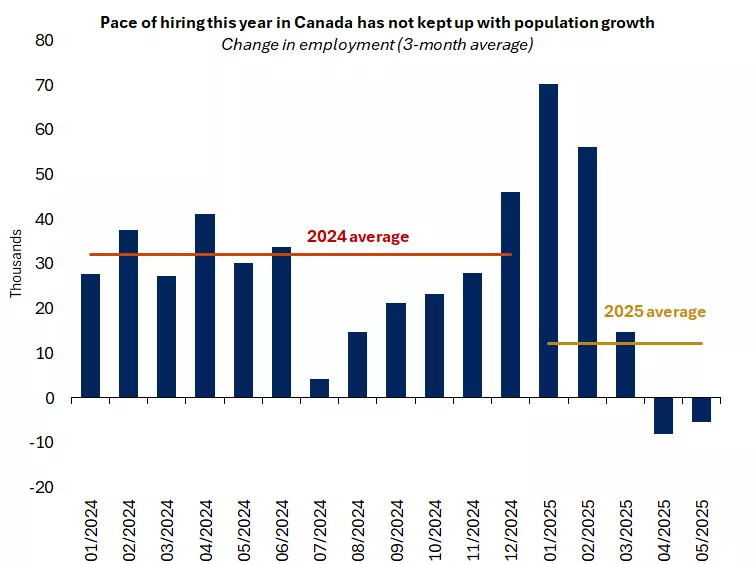

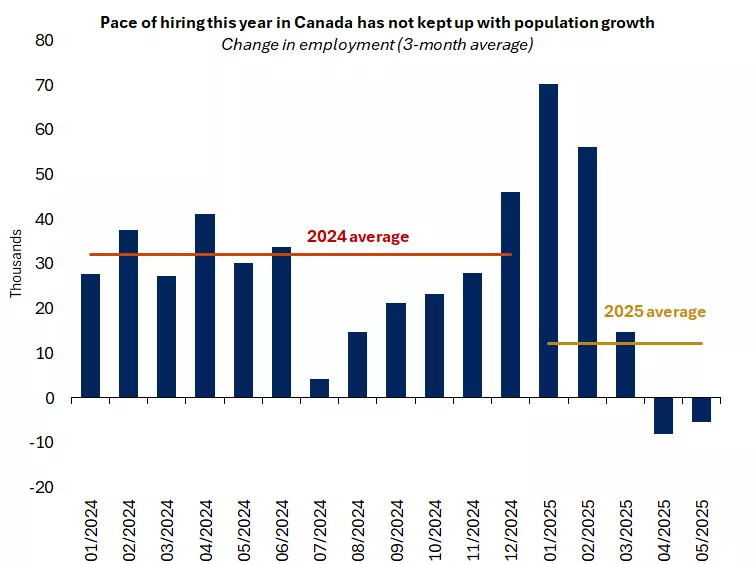

The Canadian economy added 8,800 jobs in May, a positive surprise relative to the modest loss that was expected. However, this pace of hiring is not enough to keep pace with population growth. As a result, the unemployment rate edged up to 7%, the highest since 2016 excluding the pandemic period1.

Unsurprisingly, public-sector employment fell, as the hiring of temporary workers for the April election reversed. But weakness was also evident in trade-sensitive sectors, as the U.S. tariff effects start to show. Employment declined in manufacturing, transportation and warehousing, and construction.

We think this year's weakening trend won’t go unnoticed by the Bank of Canada (BoC), which this week held its key interest rate at 2.75% for a second straight meeting. Elevated core inflation and strong first-quarter growth drove the pause. But the exports surge is unlikely to be repeated. We think that before long, the BoC will return to rate cuts as the economy goes through a soft patch in the quarters ahead.

The graph shows the number of job gains in Canada, which have slowed notably this year, pushing unemployment higher.

The graph shows the number of job gains in Canada, which have slowed notably this year, pushing unemployment higher.

U.S. labour market remains healthy, even as it gradually downshifts

South of the border, all eyes were also on the labour market, as employment trends remain a key gauge of consumer strength amid ongoing tariff headwinds. To the market's relief, the May data helped ease concerns about a sharp slowdown, showing that while the hiring is gradually cooling, the sky is not falling.

Digging into the details, the U.S. economy added 139,000 jobs in May, slightly above expectations, while the unemployment rate held steady at 4.2%. For context, that rate remains in the lowest 10% of all historical observations dating back to 19481. This year's theme of low hiring and low firing persists, while wage growth continues to outpace the rate of inflation.

However, the May report wasn't without blemishes. Job gains for the previous two months saw sizable downward revisions, a persistent trend over the past three months. The labour-force participation rate also declined, possibly reflecting tighter immigration policy.

Overall, we think the report underscores the resilience of the U.S. economy, even amid signs of moderation. With limited evidence of broad tariff-related damage so far, the data helps support the case for the Fed to remain on hold for now.

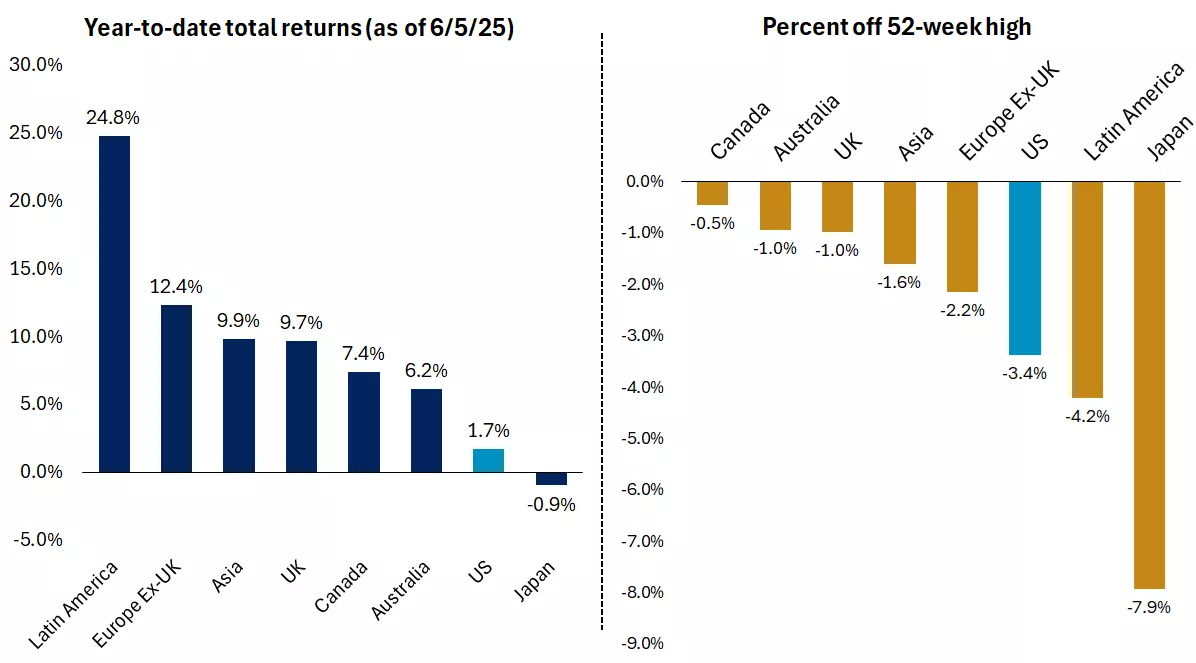

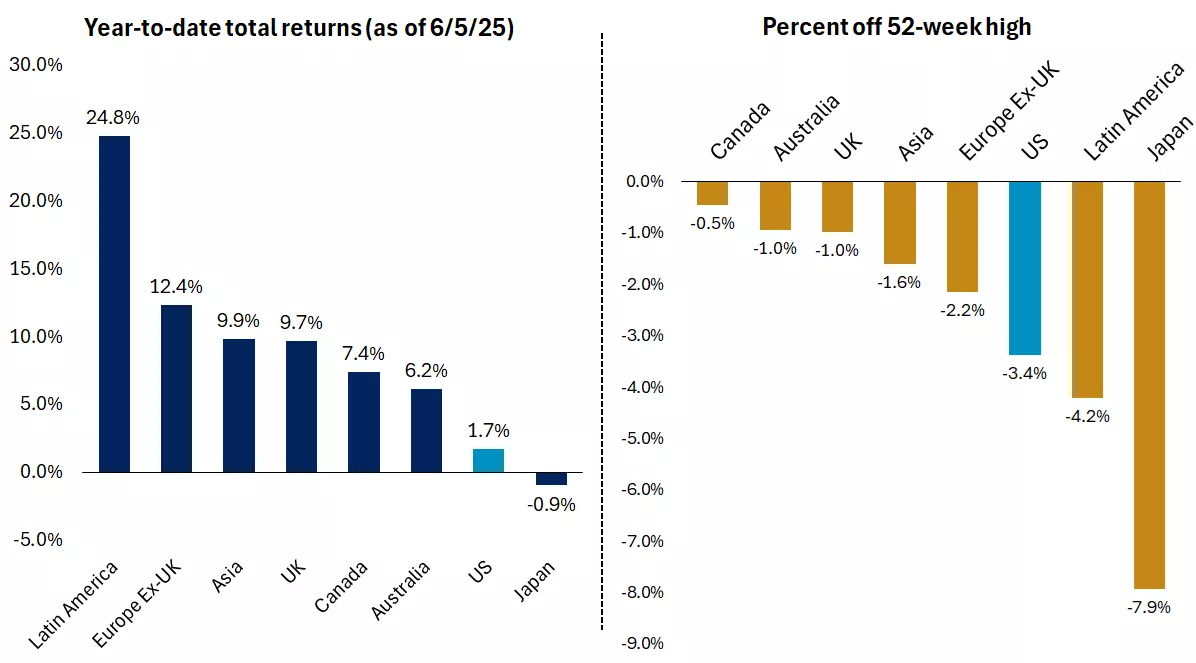

Market check: Two months off the low and gaining ground

Last week the MSCI All Country World Index, a proxy for global equities, reached an all-time high. This outcome wasn't widely expected following the announcement of steep tariffs. Yet just two months after the April 8 low, stocks have mounted an impressive recovery, with the S&P 500 gaining 20% and the TSX gaining 17% since then1.

We don't think this rally is built on sand, as it is supported by still-solid fundamentals. Trade tensions have eased, policy focus has shifted toward tax cuts, and economic data remain resilient. And corporate profits continue to grow at a healthy pace (more on that below). That said, valuations have completed a full round trip, which could foster a sense of complacency and leave less margin for error as growth decelerates.

Nevertheless, we think markets are appropriately beginning to look ahead, setting their eyes on the possibility of more stimulative fiscal and monetary policies in 2026.

The graph shows returns for major equity markets across the world and how far off these indexes are away from their 52-week high. Global stocks have made an impressive recovery over the past two months. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

The graph shows returns for major equity markets across the world and how far off these indexes are away from their 52-week high. Global stocks have made an impressive recovery over the past two months. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

First-quarter earnings season wraps up, underscoring corporate strength

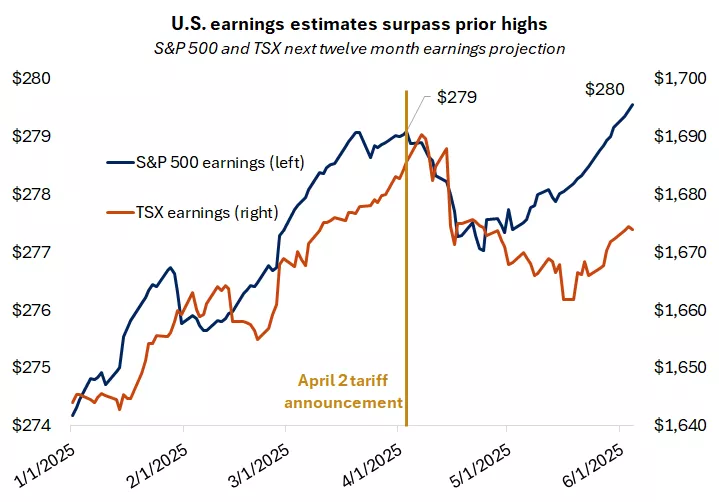

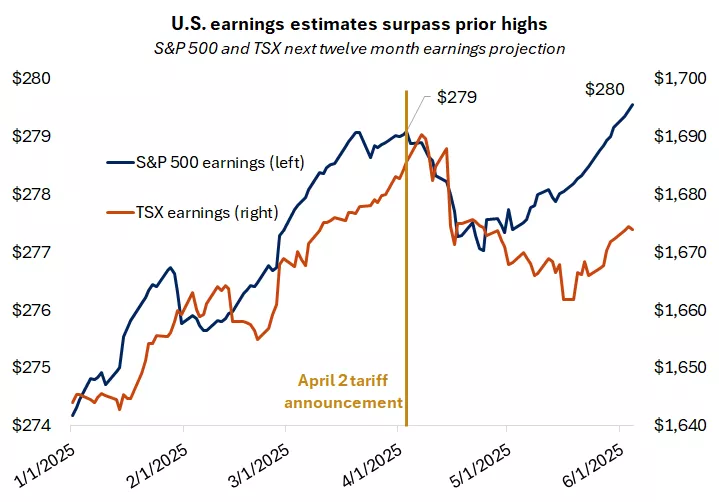

Despite macroeconomic headwinds and headline volatility, S&P 500 and TSX companies delivered solid results, growing profits 12.5% and 16.5% year-over-year. While earnings growth estimates for 2025 have been revised down, the 2026 outlook remains steady, pointing to the potential for reacceleration2.

Notably, the forward 12-month earnings estimate has recently reached a new high in the U.S., providing a fundamental anchor for rising equity markets. While valuations have undoubtedly contributed to the recent gains, earnings appear to have also played an important role in supporting the rally from the bottom.

A pull forward in demand ahead of higher tariffs may have boosted first-quarter results. Still, much of the upside came from the three growth sectors - information technology, communication services and consumer discretionary - which together account for over 50% of the S&P 500. Tech earnings grew 20%, communication services surged 33%, and consumer discretionary rose 8%, helping to restore investor confidence in this part of the market that fell briefly out of favour earlier this year2.

Results also highlighted robust spending on artificial intelligence (AI), helping NVIDIA reclaim the title of world’s most valuable company2.

The graph shows the forward 12-month S&P 500 earnings estimate which has recently reached a new high. That is not however the case for the TSX. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

The graph shows the forward 12-month S&P 500 earnings estimate which has recently reached a new high. That is not however the case for the TSX. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

What's ahead

1) Trade developments - The July 9 expiration of the 90-day pause on “reciprocal” tariff rates and the Aug. 12 end of China’s 90-day pause pose potential catalysts for volatility. Bilateral negotiations are complex, while new sectoral investigations on pharma and semiconductors are underway. Furthermore, the recent court decision challenging President Trump’s authority to impose reciprocal tariffs affects about two-thirds of the proposed tariff hikes and adds another wrinkle to the trade saga. Considering all the moving pieces, we suspect that these self-imposed deadlines may be extended if needed to allow more room for deals to be reached.

2) Central bank meetings – Two months ago the bond market was fully pricing in a rate cut at the Fed's June 18 meeting. That probability has now fallen to near zero, as the economy continues to chug along and Fed officials are taking a wait-and-see approach1. The effects of tariffs may start to appear in economic data during the summer, but the Fed is unlikely to have the clarity to act in June, or even possibly the July 30 meeting. A September move, though, appears likely. We think the Fed may cut interest rates twice this year as unemployment ticks higher and any inflation jump likely proves temporary. In Canada, markets are expecting the next rate cut in October, but we suspect it may arrive sooner1.

3) Fiscal debates and the X-date – After the House of Representatives passed the reconciliation bill ("Big Beautiful Bill") by a narrow margin, it has now moved to the Senate, and the debate about many of its provisions and their contribution to the deficit has heated up. The bill includes a boost in the debt ceiling, adding urgency to lawmakers to reach an agreement ahead of the X-date, when the Treasury runs out of cash. Treasury Secretary Bessent has urged Congress to increase or suspend the debt limit by mid-July. That timeline puts pressure on Republicans to quickly agree on a sizable tax and spending package in the coming weeks.

Resilience can continue but with bouts of volatility

Headline noise is a reality that investors will have to continue grappling with over the summer. However, even with the known unknowns on trade, the bull market remains supported by solid fundamentals. The Atlanta Fed's GDP model points to 3.8% growth in the second quarter as the import surge reversed, labour market conditions are generally healthy, and the Fed's preferred measure of inflation hit a four-year low. One would be correct to point out that this is old news, but the starting point is a healthy one as some of that strength likely fades in the second half.

Easier fiscal policy and central-bank rate cuts may help reaccelerate growth in 2026, while political and economic realities may help prevent the U.S. administration from following a very aggressive stance on trade. We continue to recommend slightly overweighting equities over bonds, though bonds can still help smooth out volatility if it re-emerges. While a significant bond rally appears unlikely without a recession, it is encouraging that the 10-year yield has fallen below 3.4% despite the perfect storm of the U.S. debt downgrade, the deficit concerns surrounding the new U.S. tax bill, and the jump in long-term Japanese bond yields.

From an investment style perspective, we think a slight preference to U.S. relative to Canadian equities and a balance between growth and value is warranted, as the recent earnings season was a good reminder of the earnings power of mega-cap tech even as the broadening in leadership continues.

Angelo Kourkafas,

Investment Strategist, CFA

1. Bloomberg; 2. FactSet.

Weekly market stats

| INDEX | CLOSE | WEEK | YTD |

|---|---|---|---|

| TSX | 26,429 | 1.0% | 6.9% |

| S&P 500 Index | 6,000 | 1.5% | 2.0% |

| MSCI EAFE * | 2,627 | 1.0% | 16.2% |

| Canada Investment Grade Bonds | -0.2% | 1.0% | |

| 10-yr GoC Yield | 3.35% | 0.1% | 0.1% |

| Oil ($/bbl) | $64.65 | 6.3% | -9.9% |

| Canadian/USD Exchange | $0.73 | 0.4% | 5.1% |

Source: FactSet, 6/6/2025. Bonds represented by the Bloomberg Canada Aggregate Bond Index. Past performance does not guarantee future results. *4-day performance ending on Thursday.

The Week Ahead

Important economic releases this week include the labour force survey and Bank of Canada interest rate decision.

Angelo Kourkafas

Angelo Kourkafas is responsible for analyzing market conditions, assessing economic trends and developing portfolio strategies and recommendations that help investors work toward their long-term financial goals.

He is a contributor to Edward Jones Market Insights and has been featured in The Wall Street Journal, CNBC, FORTUNE magazine, Marketwatch, U.S. News & World Report, The Observer and the Financial Post.

Angelo graduated magna cum laude with a bachelor’s degree in business administration from Athens University of Economics and Business in Greece and received an MBA with concentrations in finance and investments from Minnesota State University.

Important information :

The Weekly Market Update is published every Friday, after market close.

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent to international investing, including those related to currency fluctuations and foreign political and economic events.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.