U.S. Tariff Threats: Potential Impacts on Canada

On April 2, U.S. President Donald Trump announced via executive order a new tariff regime for its global trading partners. For Canada, the tariff regime remained largely as it had been in March: a blanket 25% tariff on all exports to the U.S., except those compliant with the existing USMCA agreement. Energy and potash will be tariffed at a lower 10% rate, while a 25% tariff on Canadian steel and aluminum remains in place.

In addition, the U.S. has imposed a 25% tariff on auto imports, although for Canada, that tariff will be reduced by half for cars that are made with 50% U.S.-made components or more. In response, Canadian officials introduced their own 25% tariff on U.S. car imports not compliant with USMCA. Canada, however, will not charge a tariff on U.S. automotive parts, and tariffs will not impact vehicle content from Mexico.

Overall, the average tariff rate for Canadian exports to the U.S. is expected to rise, from 1% to 2%, to around 8% to 10% given additional tariffs. However, this could move lower if the U.S. removes the tariffs which were announced in March. In this case, broader tariffs may fall to 12%, and the tariffs on energy and potash would be removed altogether.

What is a tariff? A tariff is a tax on goods imported from another country and, all else equal, increases the cost of imports, making foreign goods less competitive in the marketplace.

The economic and market impact will be determined by how long tariffs remain in place, which remains uncertain. The government's fiscal response and the Bank of Canada's monetary response to the tariff headwinds will be important drivers as well. Given the fluidity of the situation and the number of moving pieces, we recommend that investors adhere to their long-term investment strategies and resist the urge to overreact to headlines.

The current tariff regime may represent the peak level of tariffs between the U.S. and Canadian economies and could move lower over time. Nonetheless, we provide the following perspectives on the potential impact of U.S. tariffs on Canadian goods.

Impact on the economy

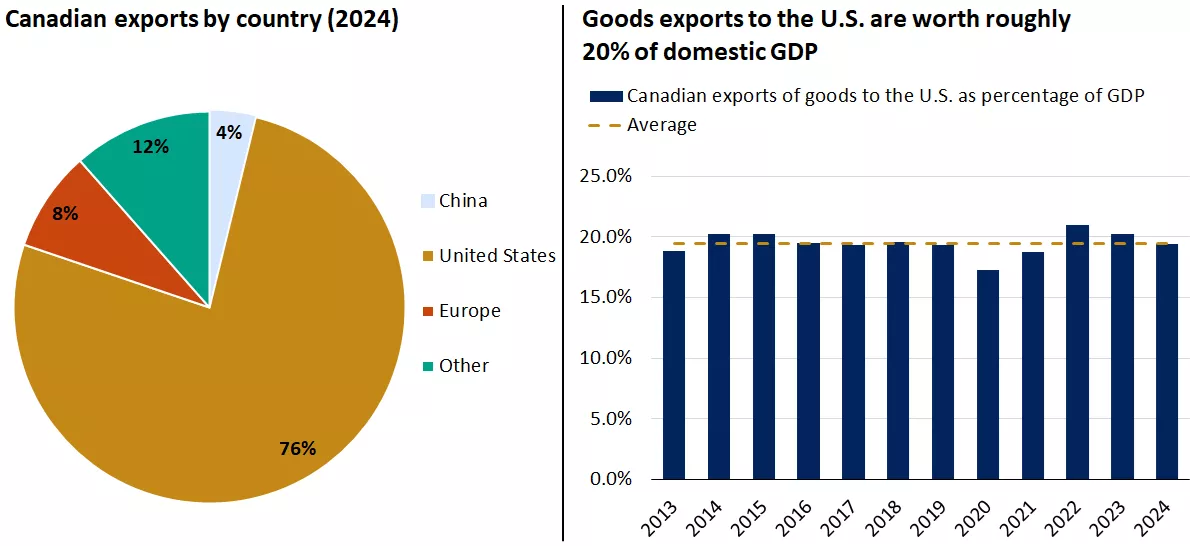

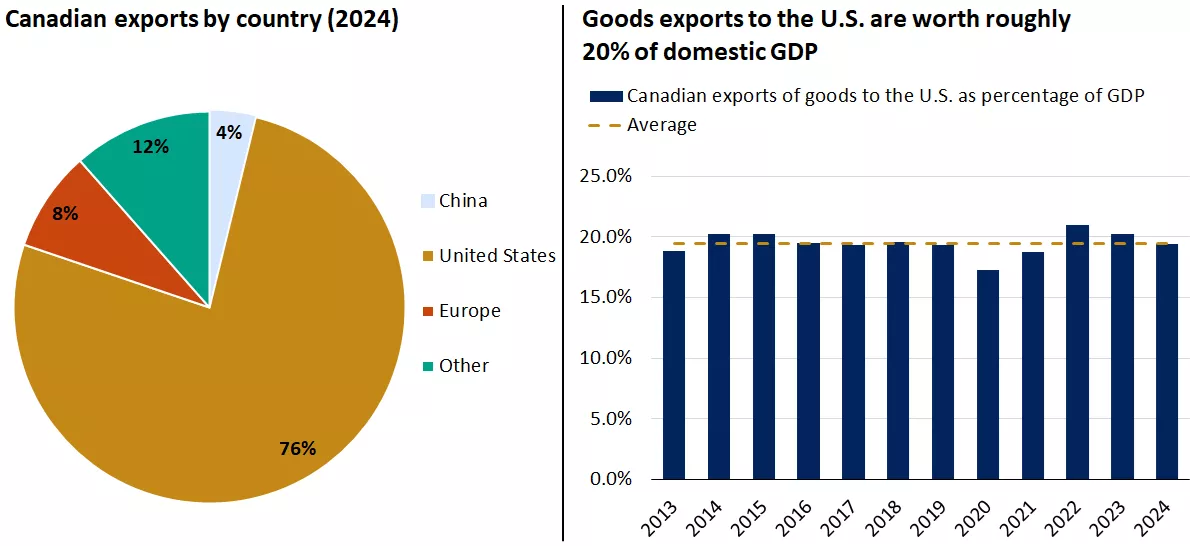

Tariffs on goods imported from Canada would likely weigh on domestic economic growth, as Canadian exports to the U.S. represent roughly 20% of domestic GDP. Tariffs would make Canadian exports less competitive and would likely lead U.S. firms to search for substitutes.

In our view, the current roughly 10% tariff regime on Canadian imports by the U.S. could substantially slow Canadian economic growth but is unlikely to cause a deep or prolonged recession, especially when considering the currency swings. Since late September, the loonie has weakened by nearly 6% against the U.S. dollar.* A weaker currency can serve as an offsetting factor to tariffs, as Canadian goods would become cheaper in U.S. dollar terms.

Economic growth would likely slow directly through lower exports. Additionally, there would be negative indirect effects, as lower exports could weigh on Canadian firm profitability, which could lead to lower employment, private investment and consumption. However, in this scenario the government would likely provide fiscal support to the economy, helping activity stabilize. We would also expect the Bank of Canada (BoC) to continue easing monetary policy to help support economic activity.

This chart shows that the U.S. was responsible for 77% of Canadian goods exports in 2024 and that Canadian goods exports to the U.S. represent roughly 20% of nominal Canadian GDP.

This chart shows that the U.S. was responsible for 77% of Canadian goods exports in 2024 and that Canadian goods exports to the U.S. represent roughly 20% of nominal Canadian GDP.

Canada has more to lose from a trade war, but there would be impacts to the U.S. economy as well. According to the U.S. Energy Information Administration, 60% of U.S. crude oil imports originated from Canada in 2023. Additionally, Canadian crude oil was responsible for 24% of U.S. refinery throughput in 2023, highlighting the importance of Canadian energy products to the U.S. Across the board, tariffs on Canadian goods would lead to higher gas prices for U.S. consumers and higher input costs for corporations. The U.S. administration is aware of this possibility, which is likely why it subjected Canadian energy imports to a lower 10% tariff rate.

Impact on inflation and central-bank policy

The combination of escalating tariffs and a potentially weaker loonie could put upward pressure on Canadian inflation, particularly goods prices.

However, we'd expect these inflationary pressures to be offset by weaker economic growth. The Bank of Canada (BoC) would likely view a rise in inflation due to tariffs as transitory and continue normalizing monetary policy through interest-rate decreases. Markets are currently pricing in about three additional rate cuts in 2025, which would bring policy rates from 2.75% to around 2.0%.*** Given the potential softening in economic growth, we believe that two to three additional rate cuts by the BoC is a reasonable scenario.

In the U.S., the combination of rising prices and potential slowdown in growth likely puts additional Fed rate cuts on hold in the near term. However, over time we believe the Fed will respond if U.S. economic growth slows, and particularly if the labour market weakens. In our view, the Fed remains poised to cut rates, but likely not until the back half of the year, when the impact to the hard data becomes more acute.

Impact on markets

While the impact of tariffs will be negative for corporate earnings, there is likely an outsized hit to U.S. companies versus Canada. Approximately one-third of the revenue generated by companies in the S&P/TSX Composite comes from the United States, with the technology, industrials and utilities sectors having the highest share of U.S. revenue.*

However, some of those sectors that export large amounts of goods to the U.S. have small representation in the Canadian equity market. For example, automotive components are the second-largest category of exports after oil, gas and minerals, accounting for 10% of Canada's exports to the U.S.** Yet, the industry only represents 0.5% of the TSX's total weight.* The primary companies producing and exporting these goods to the U.S. are Ford, GM and Stellantis, all domiciled in the U.S.

Conversely, many of the largest sectors in the TSX don't export physical goods to the U.S., and therefore wouldn't be directly impacted by tariffs. For example, the financials sector, which comprises roughly one-third of the TSX, would see limited direct impact from a tariff on goods exported to the U.S. However, the indirect effect of slower economic growth could weigh on broader performance over time.

The sectors most exposed to tariffs in the near term are energy and materials. For these sectors, however, commodity prices – not tariffs – are likely to be the primary driver of performance.

This chart shows the percent of revenue that is generated from the U.S. for the S&P/TSX Composite and the GICS sectors of the S&P/TSX Composite.

This chart shows the percent of revenue that is generated from the U.S. for the S&P/TSX Composite and the GICS sectors of the S&P/TSX Composite.

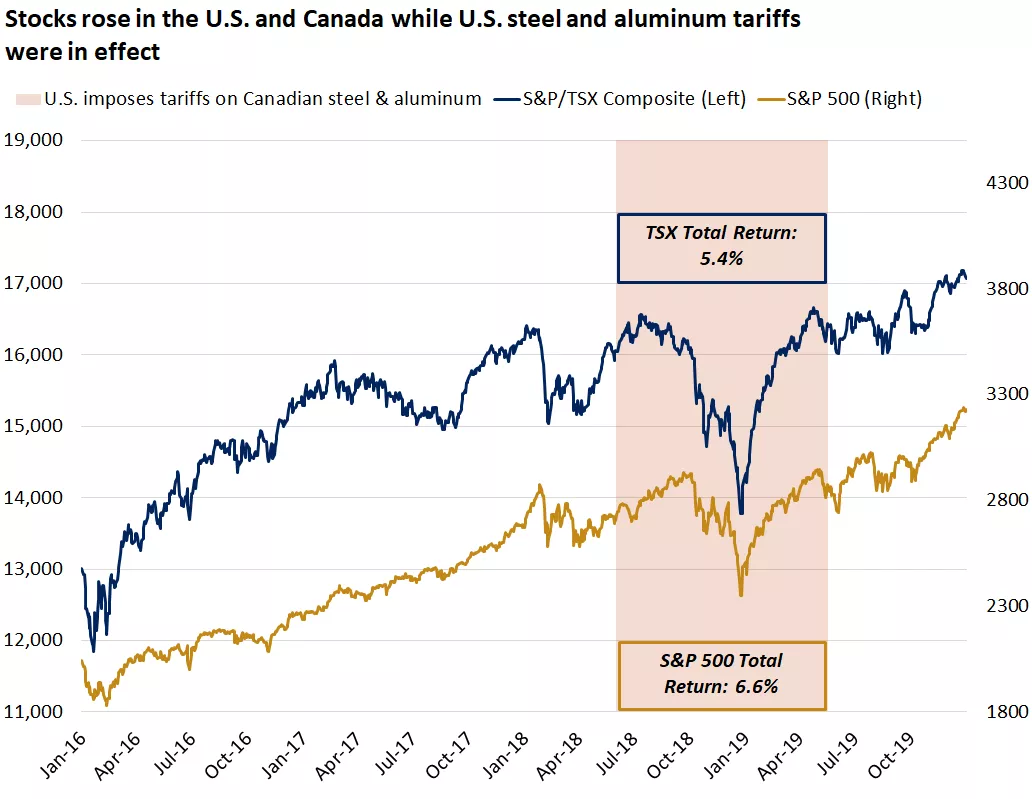

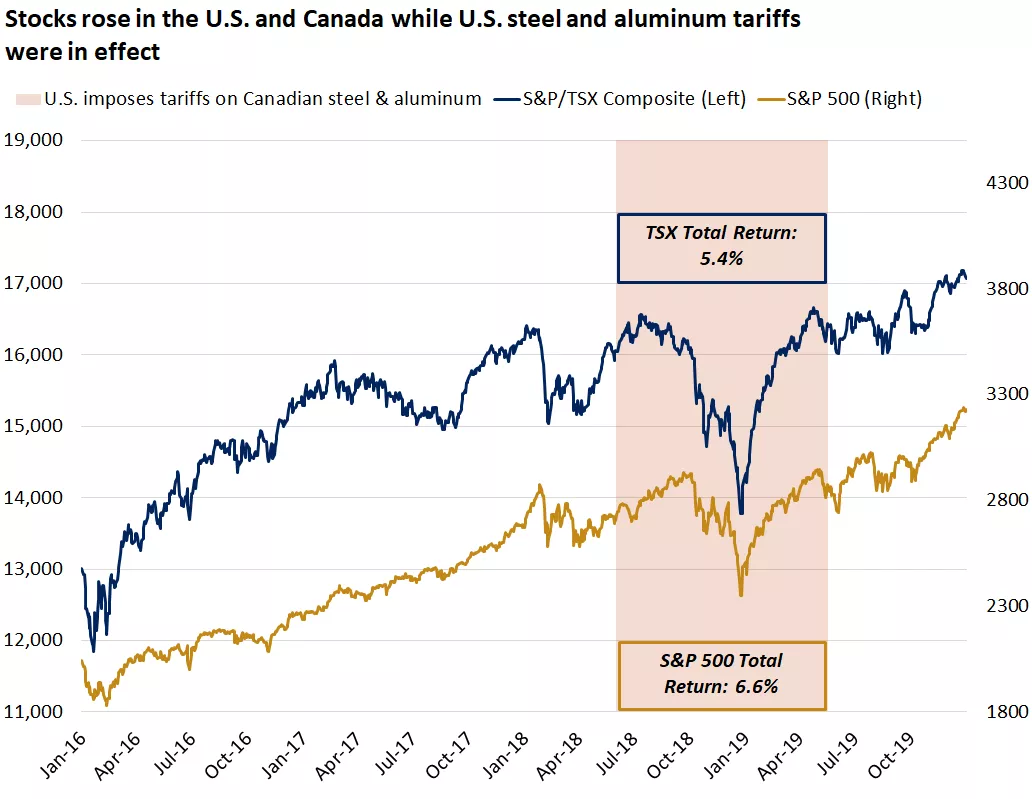

During Donald Trump's first term in office, his administration applied targeted tariffs to steel and aluminum imports in 2018, before exempting Canada and Mexico in 2019. Over this time, stock markets in Canada and the U.S. were unfazed by the tariffs, with the TSX gaining roughly 5% and the S&P 500 nearly 7% over this time. Though there was a spike in volatility and a sizable market pullback at the end of 2018, it was driven by concerns about the Fed rate hikes rather than trade.*

In our view, the current tariffs could have a larger impact on markets than the targeted tariffs in the 2018-2019 experience. However, the fundamental backdrop remains supportive. Unlike 2018, central banks are cutting rates instead of hiking them, and both Canadian and U.S. economies are expanding while corporate profits were rising heading into 2025.

This chart shows the performance of the S&P/TSX Composite and S&P 500 Indexes while steel and aluminum tariffs were in effect from June 1, 2018 to May 17, 2019. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

This chart shows the performance of the S&P/TSX Composite and S&P 500 Indexes while steel and aluminum tariffs were in effect from June 1, 2018 to May 17, 2019. Past performance does not guarantee future results. An index is unmanaged, cannot be invested into directly and is not meant to depict an actual investment.

The bottom line

Developments on trade will be a source of uncertainty in the weeks and months ahead. However, weakness in the Canadian dollar and potential fiscal support would provide offsets, while the TSX, based on its sector composition, may not be as exposed to tariffs. We recommend investors avoid the temptation to abandon long-term strategies in hopes of avoiding short-term dips. Historically, fear and panic have not paid off.

Portfolios that feature asset class and geographic diversification may be less susceptible to the investment risk that could arise from a trade war. We believe our opportunistic asset-allocation guidance is well-positioned for the current environment. We continue to recommend a slight underweight to Canadian large-cap and developed overseas large-cap, offset with an overweight to U.S. large-cap and U.S. small- and mid-cap stocks. We also believe maintaining strategic allocations to bonds helps provide an offset to equity-market volatility. If you have questions about how your portfolio is positioned and how it will help you meet your personal financial goals, speak to your Edward Jones Financial Advisor.

Angelo Kourkafas, CFA

Investment Strategist

Mona Mahajan

Investment Strategist

Brock Weimer, CFA

Associate Analyst

Important information:

Source: *FactSet. **Observatory of economic complexity, Edward Jones. ***Bloomberg

This is for informational purposes only and should not be interpreted as specific investment advice. Investors should make investment decisions based on their unique investment objectives and financial situation. While the information is believed to be accurate, it is not guaranteed and is subject to change without notice.

Before investing in bonds, you should understand the risks involved, including credit risk and market risk. Bond investments are also subject to interest rate risk such that when interest rates rise, the prices of bonds can decrease, and the investor can lose principal value if the investment is sold prior to maturity.

Investors should understand the risks involved in owning investments, including interest rate risk, credit risk and market risk. The value of investments fluctuates and investors can lose some or all of their principal.

Past performance does not guarantee future results.

Market indexes are unmanaged and cannot be invested into directly and are not meant to depict an actual investment.

Diversification does not guarantee a profit or protect against loss in declining markets.

Systematic investing does not guarantee a profit or protect against loss. Investors should consider their willingness to keep investing when share prices are declining.

Dividends may be increased, decreased or eliminated at any time without notice.

Special risks are inherent in international investing, including those related to currency fluctuations and foreign political and economic events.